Muriel Siebert & Co., Inc., 1970s

I had to give more and better advice, information and service than customers could get from anyone else.(1)

—Muriel Siebert

Muriel Siebert joined the NYSE as an individual seat holder on December 28, 1967. On January 2, 1968, she set up business at the Equitable Building at 120 Broadway; two years later she relocated to the Bankers Trust Building at 280 Park Avenue. On June 16, 1969, when she took on two partners, her firm became incorporated as Muriel Siebert & Co., Inc. She explained that she would not trade on the floor herself, but with her own brokerage she would have more control over buying and selling stocks. As president and chair of the board of the company, Siebert became the first woman to establish, own, and operate a business on the NYSE.(2)

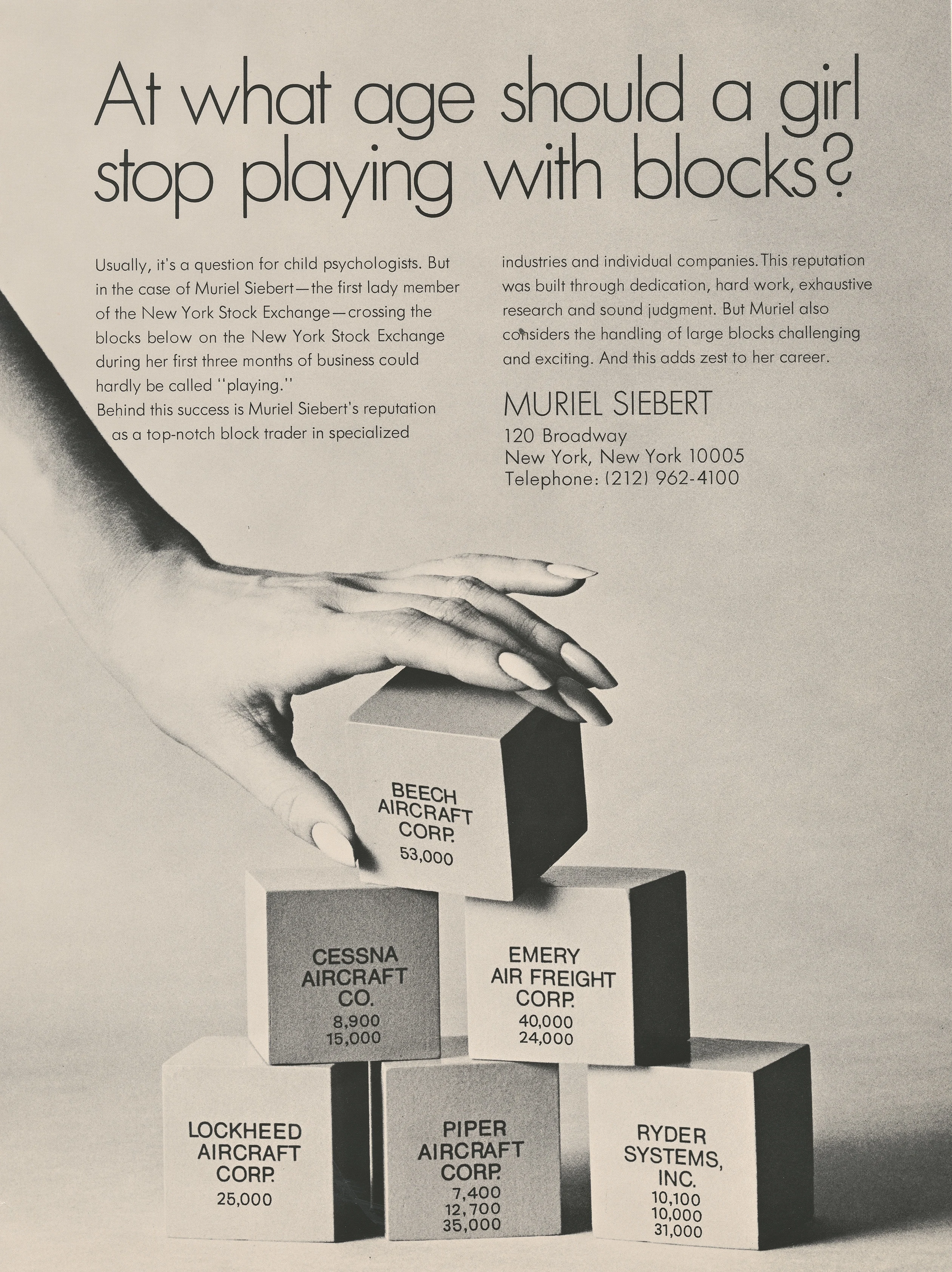

"At What Age Should a Girl Stop Playing with Blocks?" Advertisement, 1968, Muriel Siebert. MSC, b. 90, f. 5.

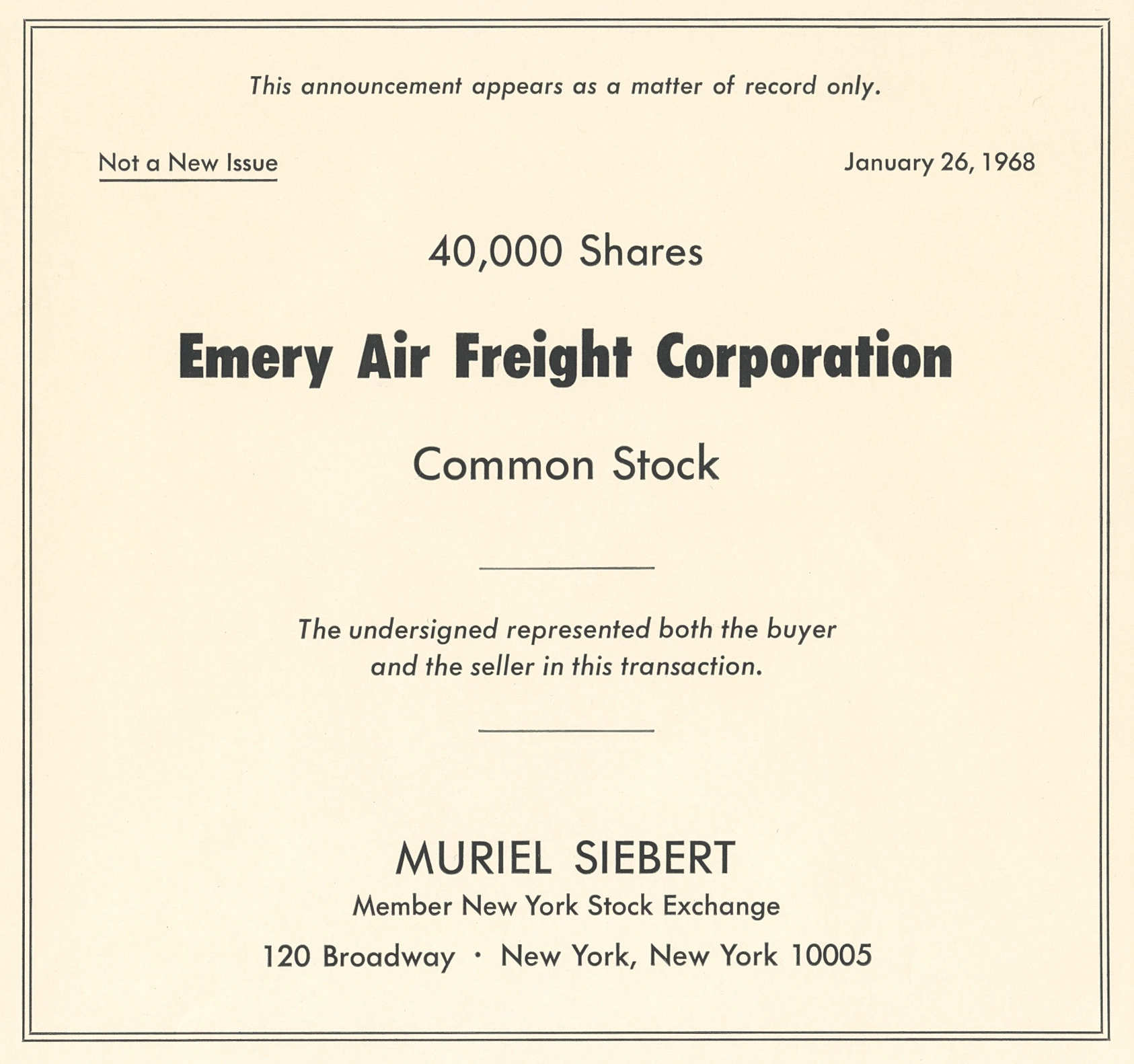

Known as a block trader, Siebert bought and sold large blocks of securities: “My specialty was handling buy-and-sell orders in the stock I researched and recommended to major investment funds, pension funds and banks, earning commissions from either the buyer, the seller or both. These deals put a premium on knowing a few stocks backward and forward.”(3) Siebert said she “followed a few companies every day and tried to add one or two new stocks a year, looking for an industry where I could see good growth. Once I found a stock that suited me, selling to institutions was just like selling shoes—knowing the customer as well as the stock, getting a good fit. . . . [T]here’s great creativity involved in helping companies finance future growth and building up research staffs to advise businesses or individuals on how to invest.”(4)

Emery Air Freight Corporation, announcement of sale of stock, January 26, 1968, Muriel Siebert. MSC, b. 147, f. 27.

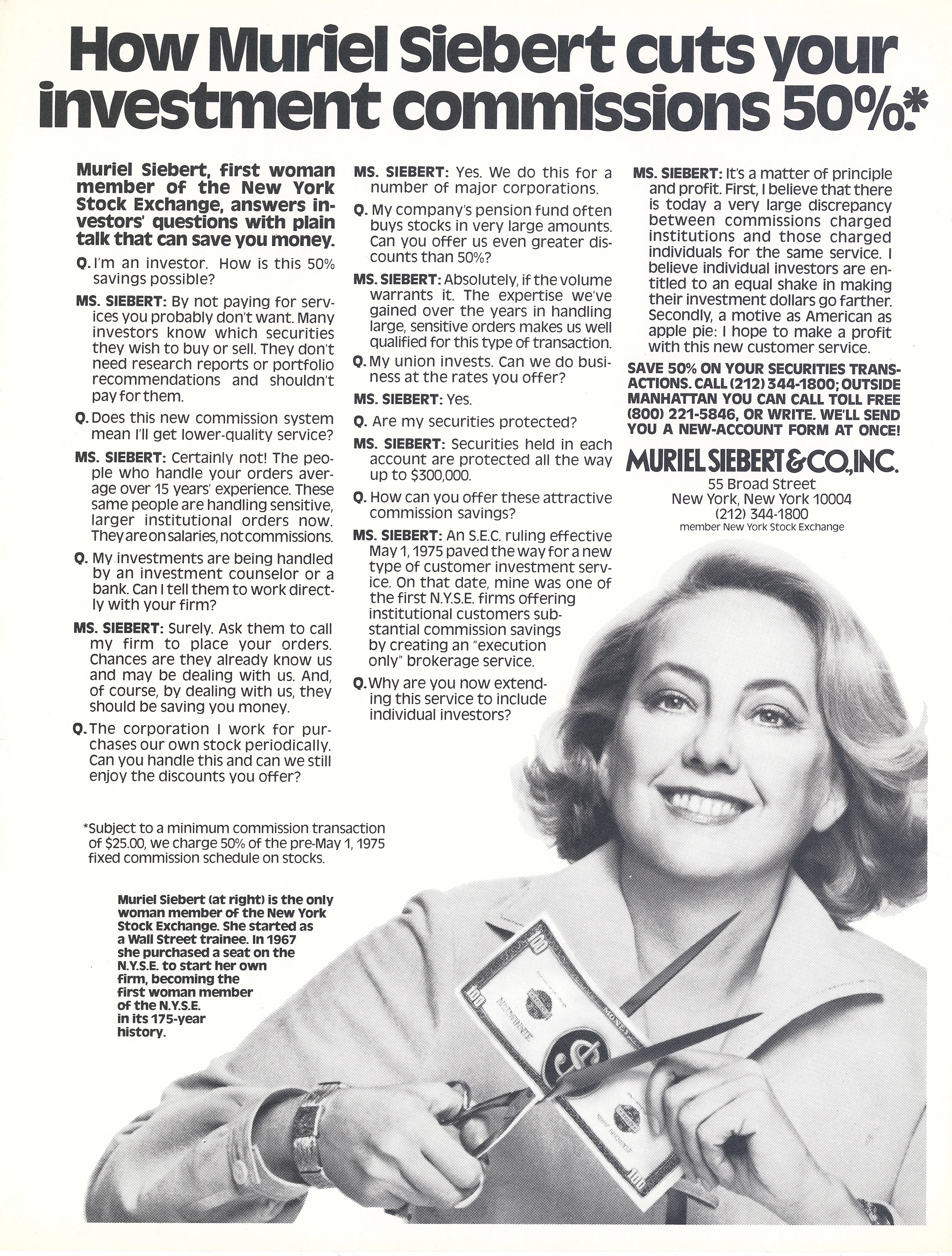

The NYSE operated under a system of fixed commission rates in which member firms charged a set fee for transactions. In 1975, the Securities and Exchange Commission ended fixed rates and implemented regulations allowing NYSE members to negotiate fees. On May 1 of that year, known on Wall Street as “May Day,” the new regulations opened potential competition among brokerage firms that could now establish their own rates and pass the savings on to customers. On May Day, Siebert was among the first to transform her company into a discount brokerage. Muriel Siebert & Co., Inc., would now work with institutions as well as individual investors, providing execution-only services for buying and selling orders without investment advice or research. Siebert explained in a press release that her company would offer individuals the same commission rates as institutional clients, noting her rationale was motivated by “principal and profit.”(5)

"How Muriel Siebert Cuts Your Investment Commissions 50%." Advertisement, Muriel Siebert & Co., Inc. MSC, b. 79, f. 12.

“It was never intended that the ‘little guy’ without bargaining power would subsidize the institutions. . . . Individuals pay significantly more to buy and sell stock than the institutions do,” Siebert argued. “The small investor deserves an even break. And I’m willing to bet there are opportunities in offering him that break.”(6) Author Sheri Caplan writes that “Siebert perceived the business opportunity afford[ed] by the changing regulations and repositioned her company as a discount brokerage. . . . This was not a popular choice among a Wall Street community already reeling from reduced profits.”(7) Muriel Siebert & Co. went on to become one of the largest independent discount brokerages.

Siebert appreciated the power of public relations and remained closely involved in the advertising and marketing of her firm. Sought after for her opinion on finance and investments, she frequently spoke at conferences and appeared on television programs including Wall Street Week with Louis Rukeyser, a popular PBS show that attracted millions of viewers.

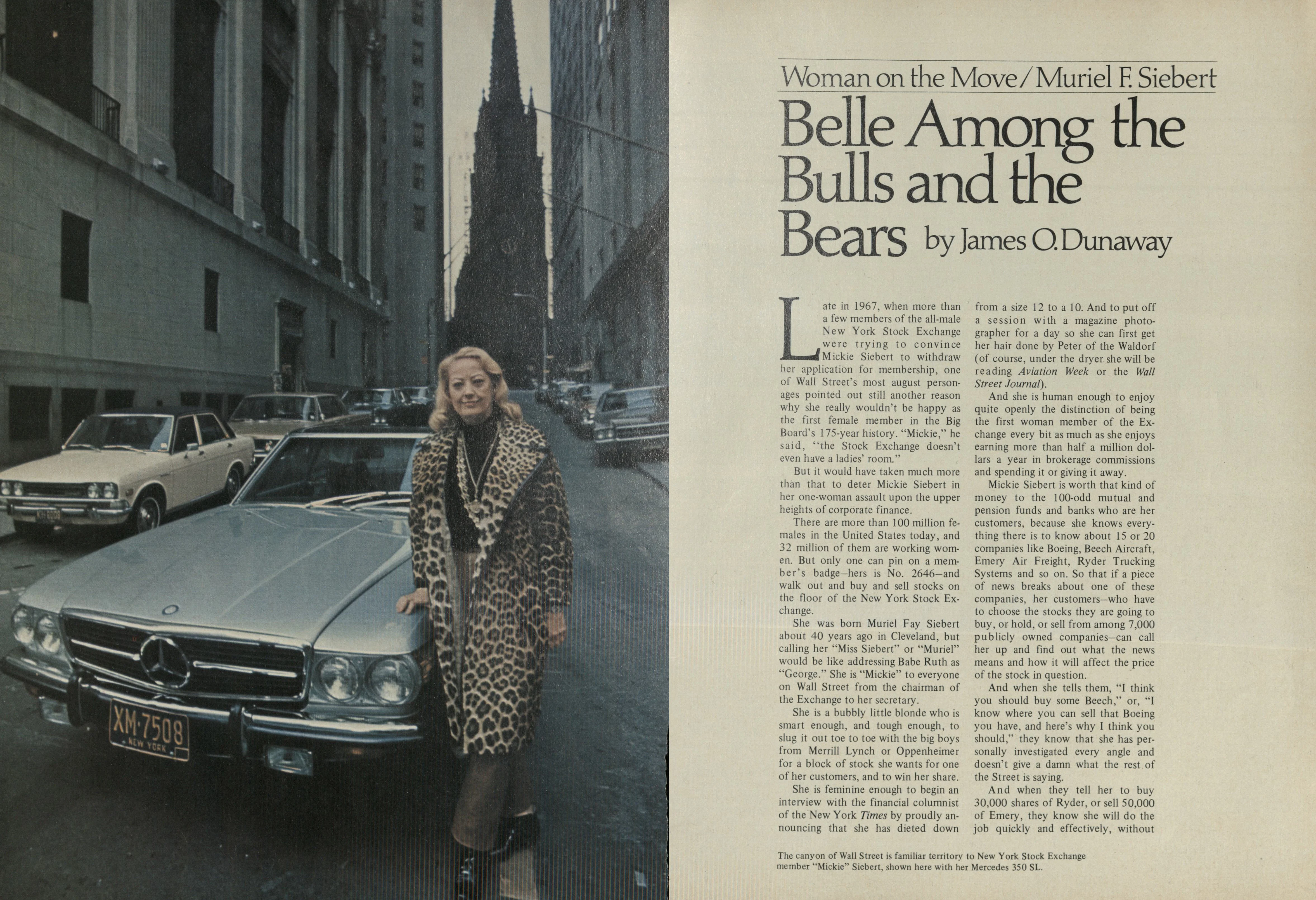

"Belle Among the Bulls and the Bears," Signature, May 1972. MSC, b. 141, f. 3.

Muriel Siebert with Monster Girl, 1996. Muriel Siebert & Co., Inc. MSC, b. 143, f. 6.

While Siebert’s rise coincided with the beginnings of the women’s movement in the 1960s, she approached business with her own distinct style. “I didn’t create my business simply by pounding on the door and saying ‘I’m a woman, I’m entitled.’ I made my success slugging it out with the boys,” she said.(8) It was as she moved from research trainee to securities trader that “I learned all my four letter words,” Siebert recalled.(9) On Wall Street, Mickie Siebert was known for her flamboyant fashion: bright colors, polka-dot patterns, leopard-skin coats. “Once I became a public figure, it was important to dress the part—none of that unisex ‘dress for success’ nonsense with the little bowtie at the neck of a dark jacket,” she wrote.(10) Siebert was frequently photographed with her beloved Chihuahua, Monster Girl (later followed by Monster Girl 2).

Siebert and Ball, Changing the Rules, 48.

Victoria Claflin Woodhull and her sister Tennessee Claflin were the first women to run a brokerage firm, Woodhull, Claflin & Co., on Wall Street in 1870.

Siebert and Ball, Changing the Rules, 44.

Siebert and Ball, Changing the Rules, 44.

"Press Release," Rand Public Relations, September 13, 1976. Muriel Siebert Collection, Box 143, Folder 3.

"Press Release," Rand Public Relations.

Sheri J. Caplan, Petticoats and Pinstripes: Portraits of Women in Wall Street’s History (Santa Barbara: Praeger, 2013), 140.

Beverly Kempton, "What Does Success Really Mean? A Conversation with Muriel Siebert," Executive Female (January/February 1993), 40. Muriel Siebert Collection, Box 133, Folder 8.

Robert A. Bennett, "Muriel Siebert: Bank 'Pioneer,'" New York Times, June 10, 1982.

Siebert and Ball, Changing the Rules, 43.