Mickie's Back, 1983–2010s

My motives have always been pride, principle and profit. I don’t know how you stay afloat and sleep at night without all three.(1)

—Muriel Siebert

During her tenure as Superintendent of Banks and her campaign for the Senate, Muriel Siebert relinquished control of her firm, which she had placed in a blind trust. After her Senate primary loss, she returned to her company. “My mother raised us to believe that with success comes obligation,” Siebert said. “When I left my position with New York State, I had some offers from major firms. Had I taken any of them, I probably would have made a lot more money, but . . . I felt an obligation to other women. Had there been ten other woman-owned firms, I might have chosen differently.”(2)

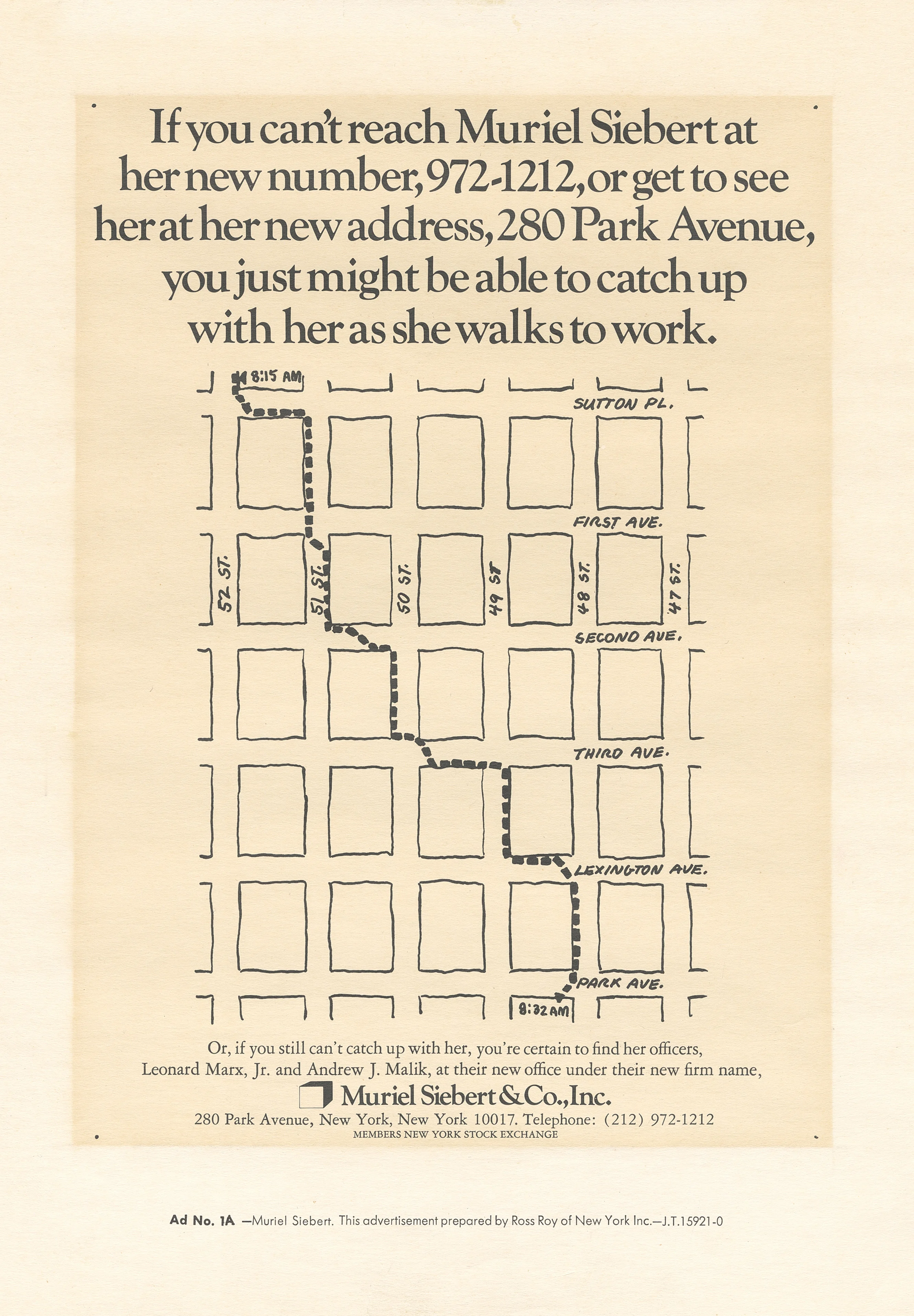

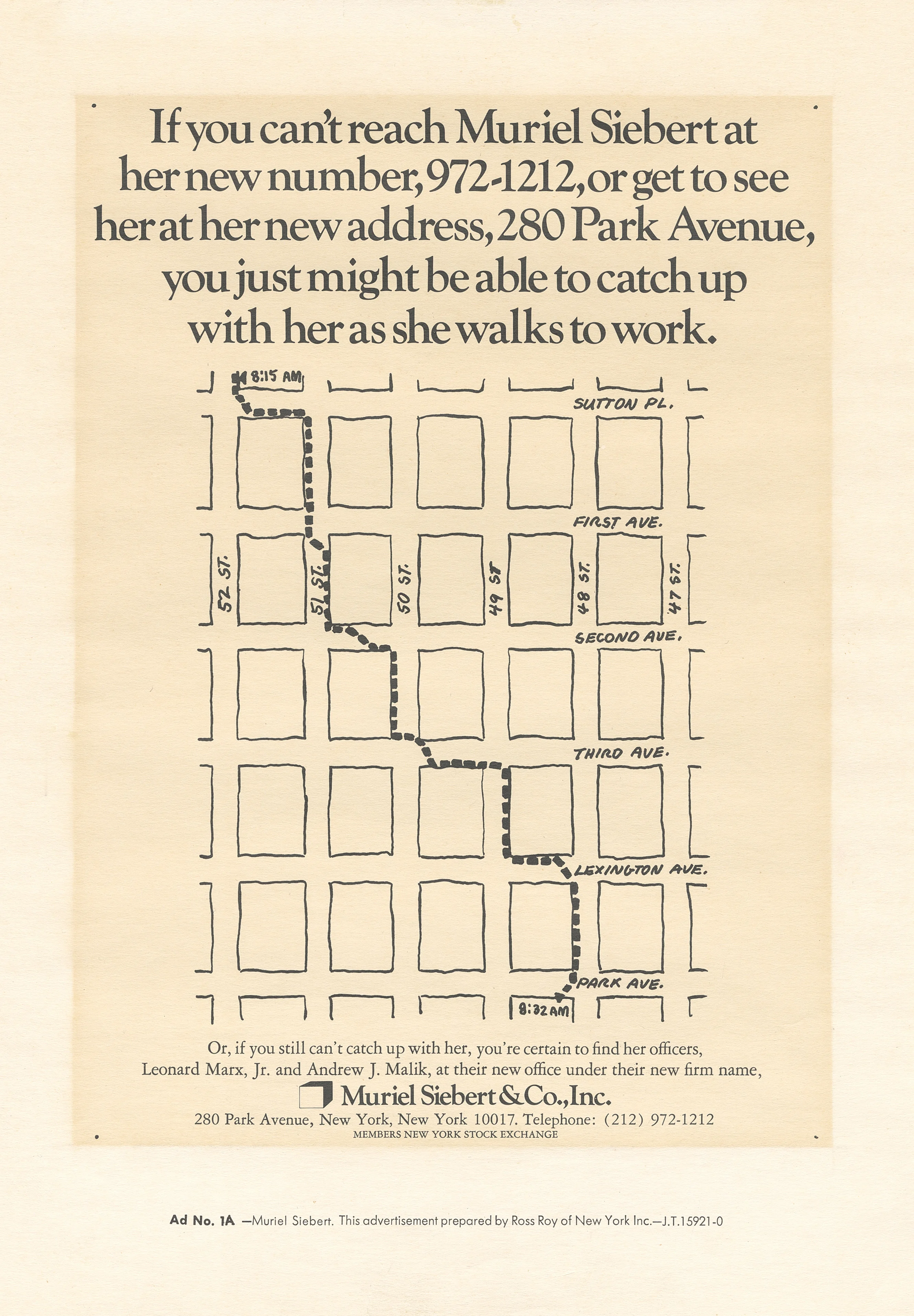

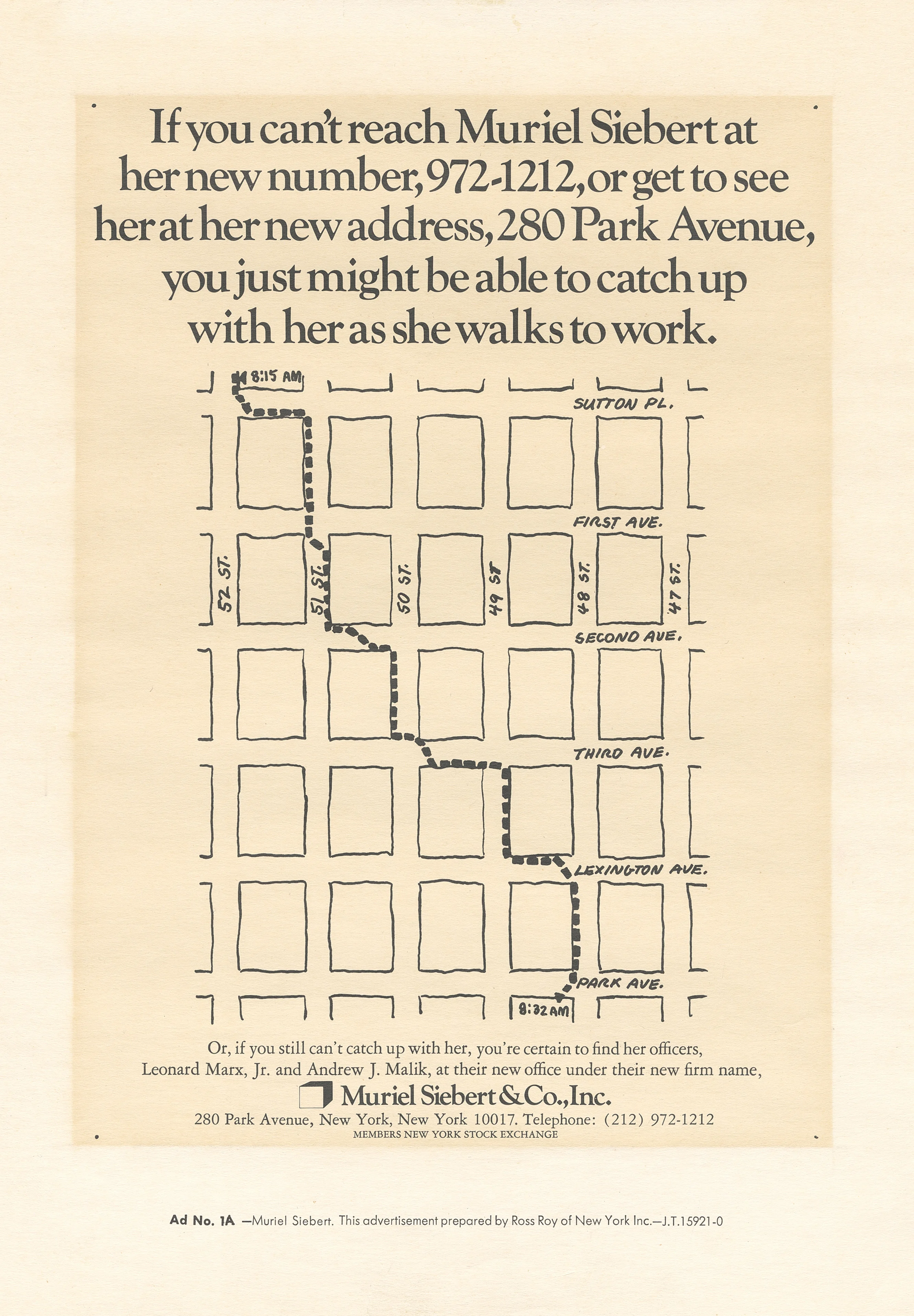

Mickie Siebert resumed her position as president of her company in 1983. With typical fanfare, she announced her return to the business. A company advertisement noted clients could catch her on her walk from her exclusive River House apartment on Sutton Place to her office at 280 Park Avenue in the Banker’s Trust Building. “In January 1983, like Rip Van Winkle waking up after a long sleep, I returned to a firm in shambles,” Siebert remembered.(3) During her absence, staff had left, and some had taken the firm’s clients with them.

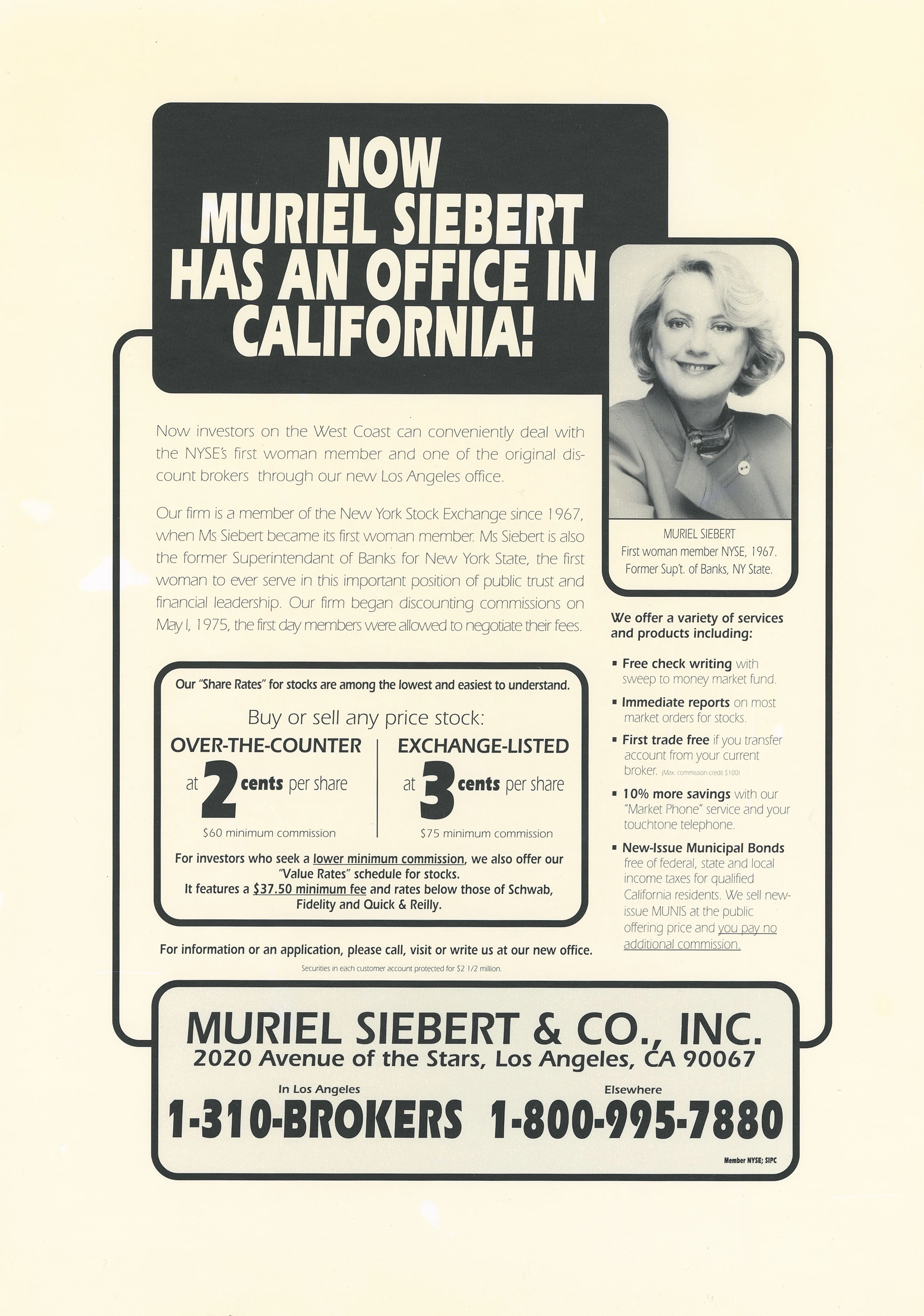

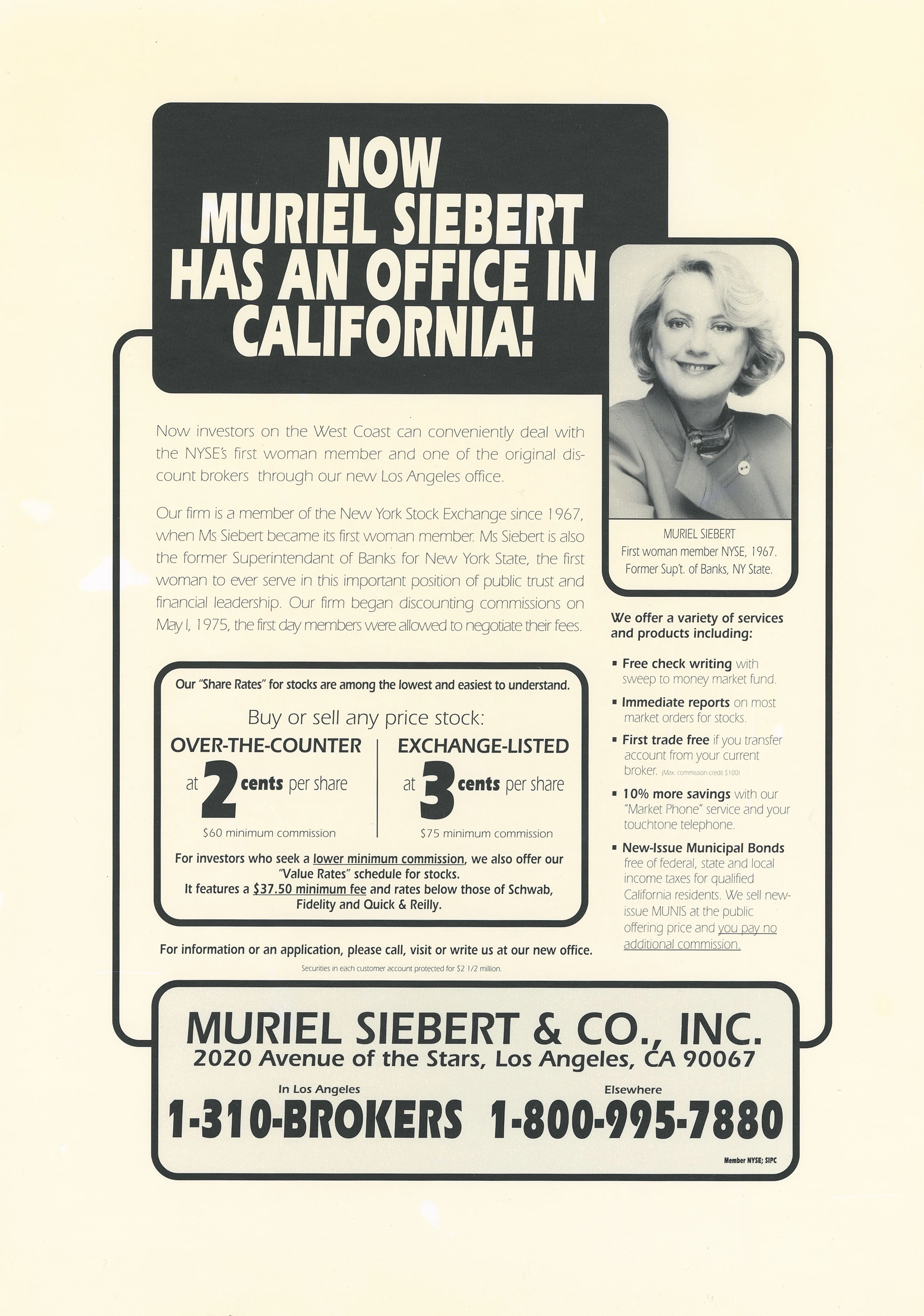

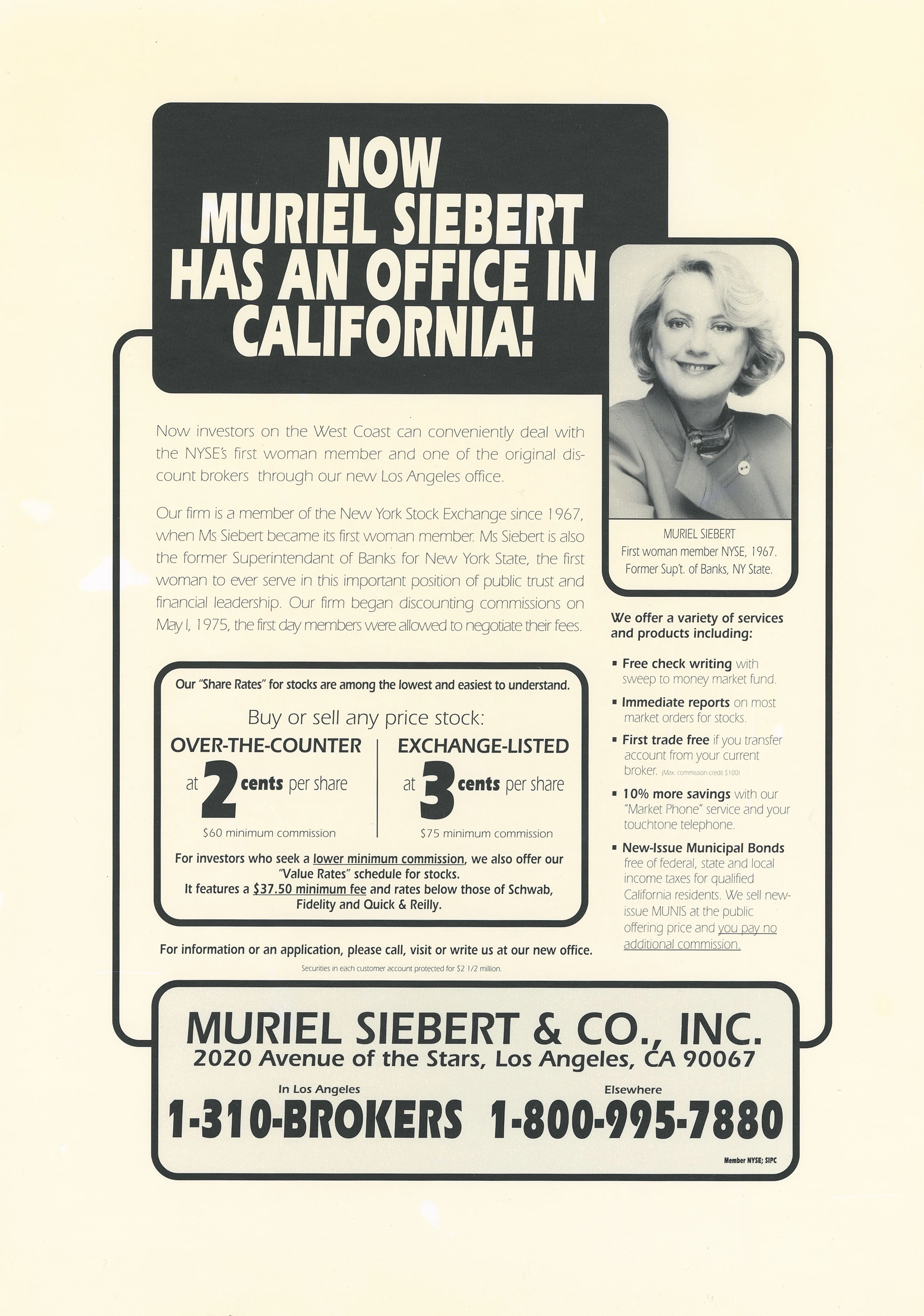

"Now Muriel Siebert Has an Office in California!" Advertisement, Muriel Siebert & Co., Inc. MSC, b. 149, f. 9.

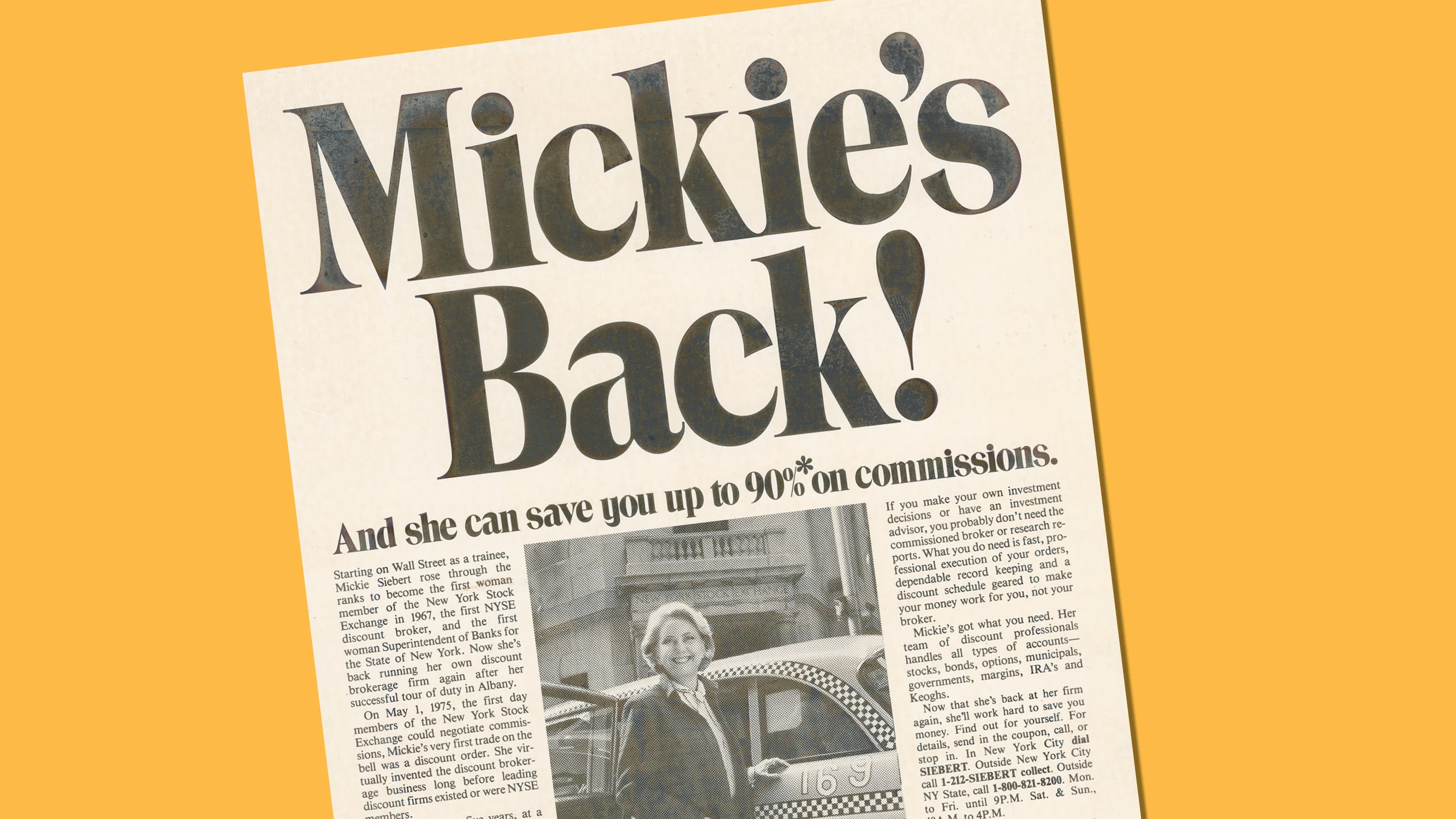

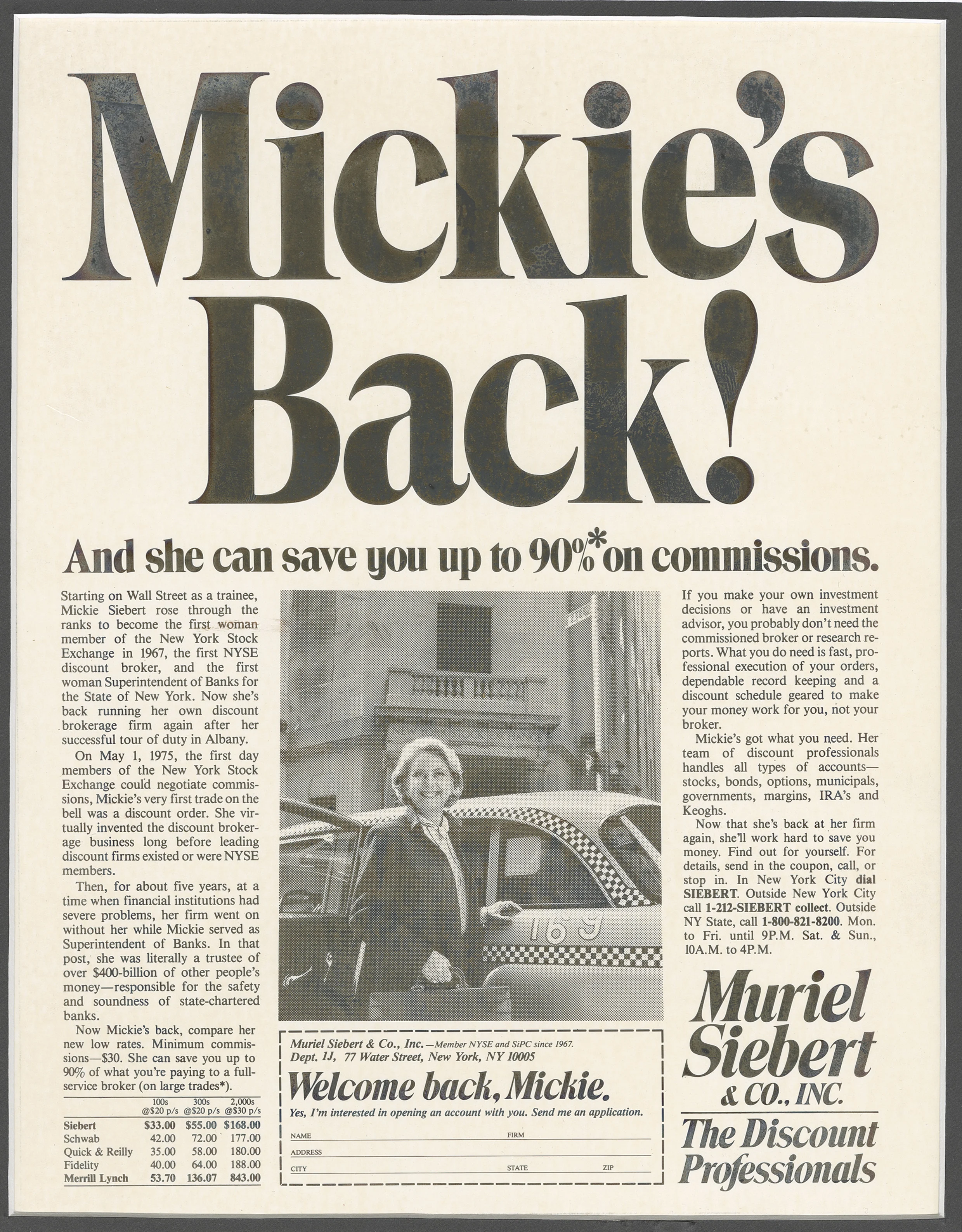

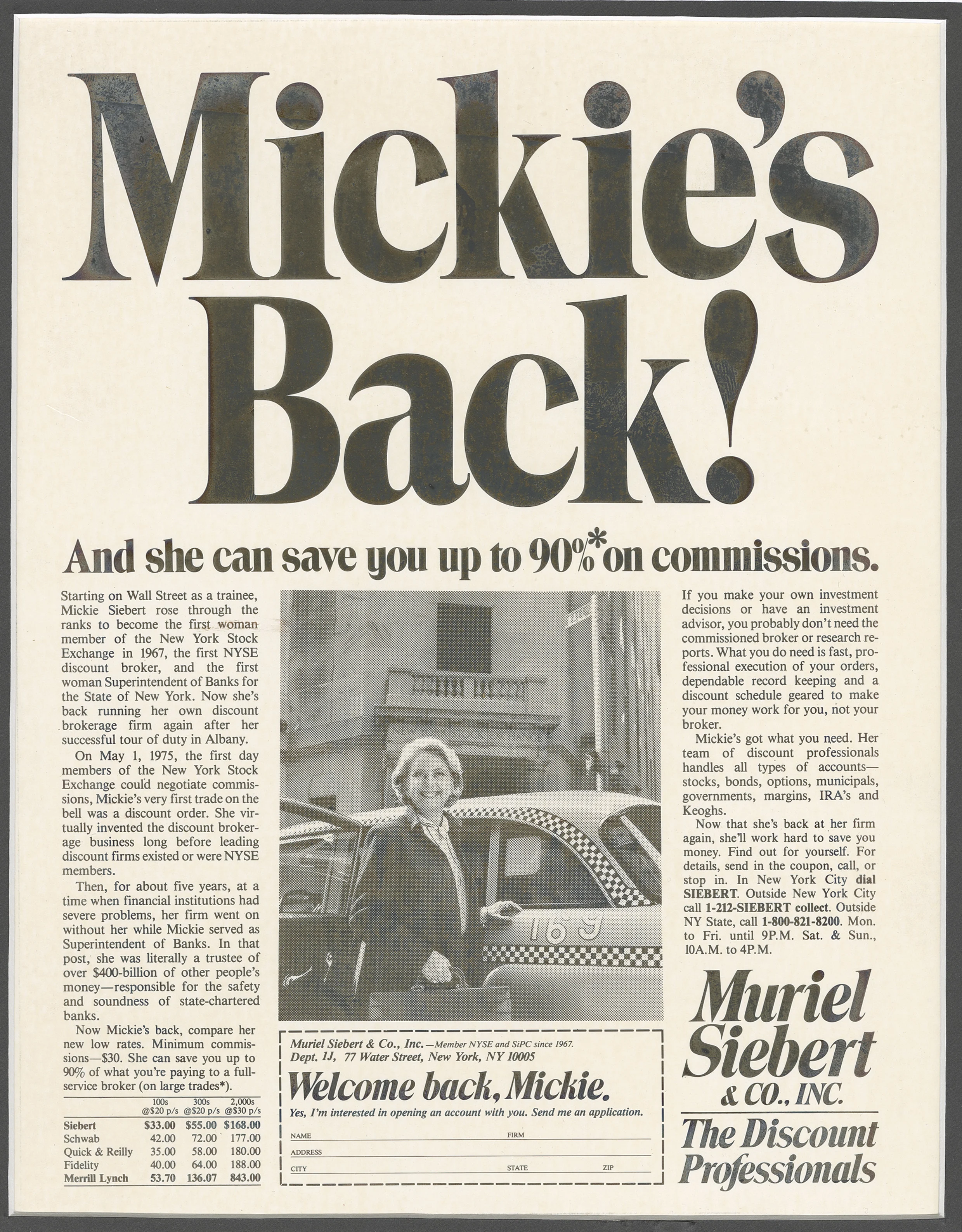

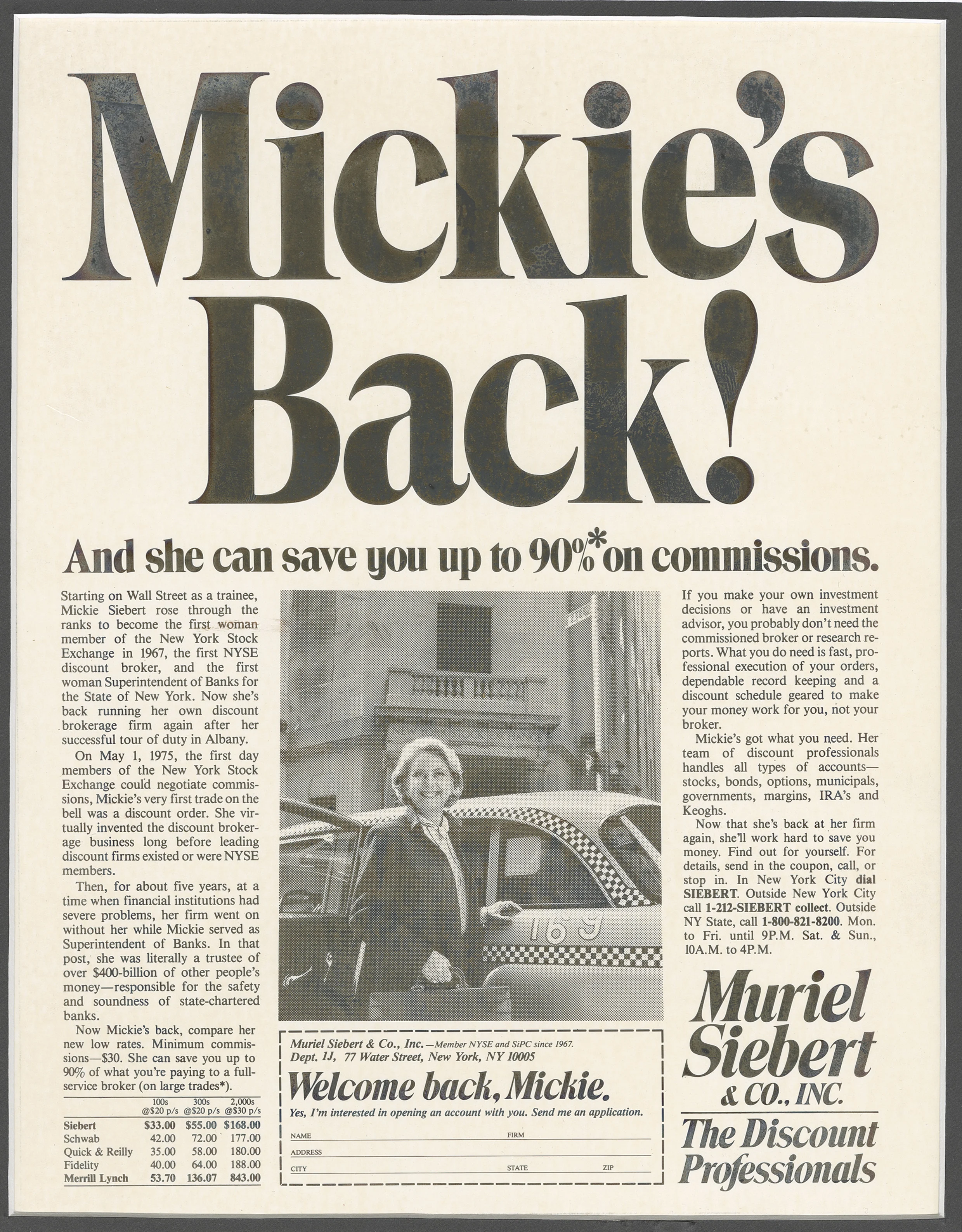

"Mickie’s Back!" Advertisement, 1983, Muriel Siebert & Co., Inc. MSC, b. 148, f. 3.

"If You Can’t Reach Muriel Siebert." Advertisement, 1983, Muriel Siebert & Co., Inc. MSC, b. 151, f. 3.

"Mickie’s Back!" Advertisement, 1983, Muriel Siebert & Co., Inc. MSC, b. 148, f. 3.

"If You Can’t Reach Muriel Siebert." Advertisement, 1983, Muriel Siebert & Co., Inc. MSC, b. 151, f. 3.

"Now Muriel Siebert Has an Office in California!" Advertisement, Muriel Siebert & Co., Inc. MSC, b. 149, f. 9.

"If You Can’t Reach Muriel Siebert." Advertisement, 1983, Muriel Siebert & Co., Inc. MSC, b. 151, f. 3.

"Now Muriel Siebert Has an Office in California!" Advertisement, Muriel Siebert & Co., Inc. MSC, b. 149, f. 9.

"Mickie’s Back!" Advertisement, 1983, Muriel Siebert & Co., Inc. MSC, b. 148, f. 3.

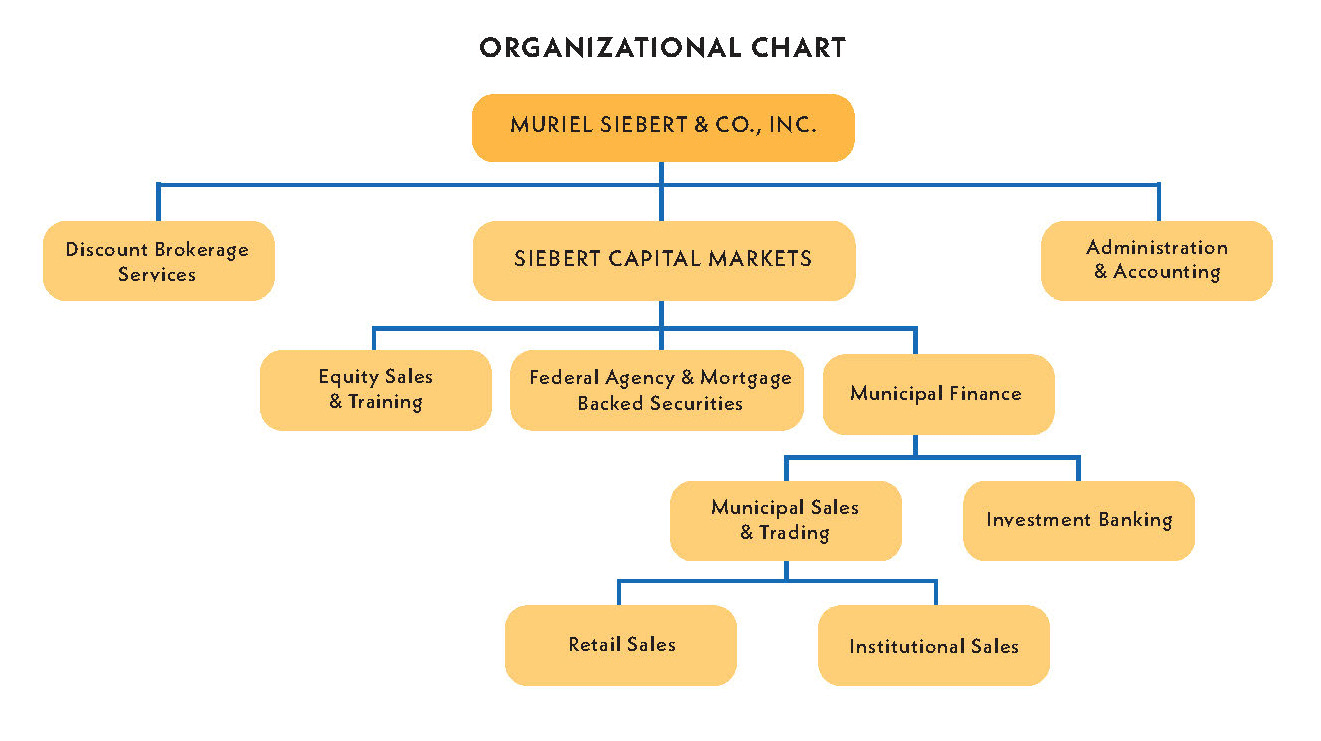

In the five years Siebert had been away, the financial landscape had also changed with the introduction of new financial products including collateralized mortgage obligations, futures, and options. Siebert worked to rebuild her company. In addition to the discount brokerage, she expanded the firm’s services by establishing the Siebert Capital Markets Division, which oversaw equities, corporate bonds, government agencies, mortgage-backed securities, and municipal finance banking and distribution. Siebert set about delivering improved customer service. She adapted to the new electronic landscape by introducing “Siebert Quotes,” which provided twenty-four-hour access to stock and option quotes. In 1996, she created SiebertNet, an early computerized trading site where the company increasingly conducted business. She also helped establish the Siebert Women’s Financial Network through the purchase of two websites serving women’s financial needs.

Recreation of organizational chart referenced in a letter from Muriel Siebert to John Lenaham, New York Local Government Assistance Corporation, July 22, 1993. MSC, b. 73, f. 9.

In 1996, Siebert decided to take her firm public through a merger with a shell company. She chose J. Michaels Furniture, a company out of Brooklyn that operated a chain of furniture stores. The assets of the company were liquidated into a trust used to create a holding company named the Siebert Financial Corporation, of which 97.5 percent was owned by Siebert and 2.5 percent was owned by J. Michaels shareholders. Siebert reasoned that taking her firm public would provide her with more options to expand the business through acquisitions.(4)

Thomas Mead, Muriel Siebert, Napoleon Brandford III, and Susanne Shank, 1996. New York Stock Exchange Archives, NYSE Group, Inc.

Siebert opened branches in Florida, California, and New Jersey. In 1996, with Napoleon Brandford III and Susanne Shank (Black partners of a bond firm), she built what was then the largest minority- and female-owned municipal-bond business, Siebert, Brandford, Shank & Co. “Someone will have to rebuild, and someone’s going to have to sell bonds to do it,” Siebert argued, citing the need for support in urban areas. “As long as there’s sensitivity to diversity and competitive equality, I feel the capable women and black-owned firms are going to make it.”(5)

Siebert and Ball, Changing the Rules, 73.

Kempton, "What Does Success Really Mean?," 40.

Siebert and Ball, Changing the Rules, 144.

"Siebert Goes Public by an Unusual Route," Bloomberg Business News, February 5, 1996. Muriel Siebert Collection, Box 78, Folder 2.

Phyllis Plitch, "Wall Street Pioneer Muriel Siebert Is Still Making a Mark with New Deals," Wall Street Journal, May 27, 1997. Muriel Siebert Collection, Box 149, Folder 5.