Baker Library Resources

Unique among business school libraries, Baker Library possesses extraordinarily comprehensive and diverse historical collections. Built over time with a consistent focus on the evolution of business and industry, the depth and scope of these collections are exceptional. There are particularly rich resources for studying company history across decades.

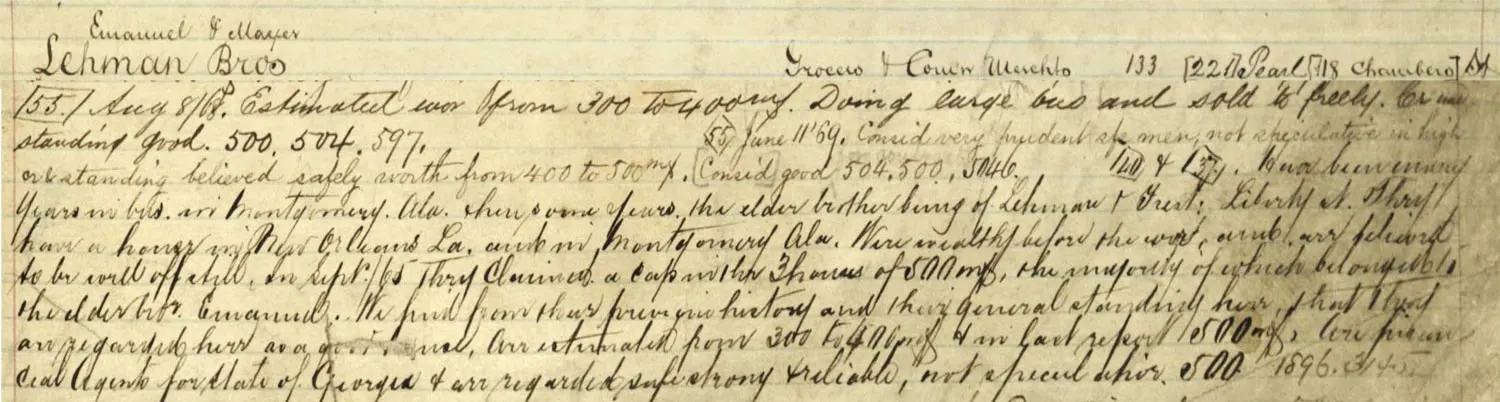

Lehman Brothers credit reports, 1868-1869. R.G. Dun & Co. Credit Report Ledgers, Baker Library, Harvard Business School.

Retired HBS Cases

El-Hage, Nabil N., and Cedric A. Lucas. “Lehman Brothers and Peabody Coal.” HBS No. 209-009. Boston: Harvard Business School Publishing, 2008.

Hill, Linda A., and Katherine Seger Weber. “Power, Greed and Glory on Wall Street: The Fall of Lehman Brothers, Parts I and II (TN).” HBS No. 494-091. Boston: Harvard Business School Publishing, 1994 (Revised 1995).

Jick, Todd D. “Merging the Investment Banking Divisions of Shearson/American Express and Lehman Brothers Kuhn Loeb (A).” HBS No. 488-043. Boston: Harvard Business School Publishing, 1988.

Jick, Todd D. “Merging the Investment Banking Divisions of Shearson/American Express and Lehman Brothers Kuhn Loeb (B)” HBS No. 488-044. Boston: Harvard Business School Publishing, 1988.

Jick, Todd D. “Merging the Investment Banking Divisions of Shearson/American Express and Lehman Brothers Kuhn Loeb (A) and (B), TN.” HBS No. 491-098. Boston: Harvard Business School Publishing, 1991.

Meerschwam, David M. “Shearson Lehman Brothers and American Express—1987.” HBS No. 290-002. Boston: Harvard Business School Publishing, 1989.

Meerschwam, David M. “Shearson Lehman Brothers and American Express—1987 TN.” HBS No. 291-060. Boston: Harvard Business School Publishing, 1991.

Paine, Lynn Sharp, and Jane Palley Katz. “Hutton Branch Manager (D).” HBS No. 396-047. Boston: Harvard Business School Publishing, 1995.

Perold, André F. “Lehman Management Co., Inc.” HBS No. 284-027. Boston: Harvard Business School Publishing, 1985.

Perold, André F., and Wai Lee. “American Express TRS Charge-Card Receivables and Lehman Brothers and the Securitization of American Express Charge-Card Receivables (TN).” HBS No. 295-158. Boston: Harvard Business School Publishing, 1995 (Revised 1996).

Thomas, David A., and Stephanie J. Creary. “Creating the Partnership Solutions Group at Lehman Brothers.” HBS No. 409-042. Boston: Harvard Business School Publishing, 2009.

Tufano, Peter. “Shearson Lehman Hutton, Inc. (A): Entry into the Covered Warrant Business.” HBS No. 291-016. Boston: Harvard Business School Publishing, 1995

Tufano, Peter. “Shearson Lehman Hutton, Inc. (A) and (B), TN.” HBS No. 296-066. Boston: Harvard Business School Publishing, 1996.

Tufano, Peter. “Shearson Lehman Hutton, Inc. (B): Euromarket Covered Warrant Execution.” HBS No. 291-017. Boston: Harvard Business School Publishing, 1996

Current HBS Cases

Di Tella, Rafael, Alberto F. Cavallo and Aldo Sesia. “Hank and Nancy: The Subprime Crisis, the Run on Lehman and the Shadow Banks, and the Decision to Bailout Wall Street.” HBS No. 718-022. Boston: Harvard Business School Publishing, 2017.

Foley, C. Fritz, and Linnea Meyer. “Nomura's Global Growth: Picking Up Pieces of Lehman.” HBS No. 210-017. Boston: Harvard Business School Publishing, 2009.

Gilson, Stuart C., Kristin Mugford and Sarah L. Abbott. “The Rise and Fall of Lehman Brothers.” HBS No. 217-041. Boston: Harvard Business School Publishing, 2017.

Groysberg, Boris, and Ashish Nanda. “Lehman Brothers (C): Decline of the Equity Research Department.” HBS No. 902-003. Boston: Harvard Business School Publishing, 2001.

Groysberg, Boris, Ashish Nanda, and Lauren Prusiner. “Lehman Brothers (A): Rise of the Equity Research Department.” HBS No. 906-034. Boston: Harvard Business School Publishing, 2006.

Groysberg, Boris, and Ashish Nanda. “Lehman Brothers (D): Reemergence of the Equity Research Department.” HBS No. 406-090. Boston: Harvard Business School Publishing, 2006.

Healy, Paul M., and Boris Groysberg. “10 Uncommon Values (R): Optimizing the Stock-Selection Process.” HBS No. 405-022. Boston: Harvard Business School Publishing, 2004.

Mikes, Anette, Gwen Yu and Dominique Hamel. “Lehman Brothers and Repo 105.” HBS No. 112-050. Boston: Harvard Business School Publishing, 2011.

Mikes, Anette, Gwen Yu and Dominique Hamel. “Lehman Brothers and Repo 105 (TN).” HBS No. 114-080. Boston: Harvard Business School Publishing, 2014.

Nanda, Ashish, Boris Groysberg, and Lauren Prusiner. “Lehman Brothers (B): Exit Jack Rivkin.” HBS No. 906-035. Boston: Harvard Business School Publishing, 2006.

Nicholas, Tom, and David Chen. “Lehman Brothers.” HBS No. 810-106. Boston: Harvard Business School Publishing, 2010.

Perold, André F., and Kuljot Singh. “American Express TRS Charge-Card Receivables.” HBS No. 293-120. Boston: Harvard Business School Publishing, 1993.

Perold, André F., and Kuljot Singh. “Lehman Brothers and the Securitization of American Express Charge-Card Receivables.” HBS No. 293-121. Boston: Harvard Business School Publishing, 1993.

Rose, Clayton, and Anand Ahuja. “Before the Fall: Lehman Brothers 2008.” HBS No. 309-093. Boston: Harvard Business School Publishing, 2009.

Rose, Clayton, and Sally Canter Ganzfried. “Before the Fall: Lehman Brothers 2008 (TN).” HBS No. 312-044. Boston: Harvard Business School Publishing, 2011.

Bibliography

Acharya, Viral V., and Matthew W. Richardson. “How Securitization Concentrated Risk.” In What Caused the Financial Crisis, ed. Jeffrey Friedman. Philadelphia: University of Pennsylvania Press, 2011.

A Centennial: Lehman Brothers, 1850–1950. New York: Lehman Brothers, 1950.

Archibald, Robert. “Mayer Lehman (1830–1897).” Immigrant Entrepreneurship: German-American Business Biographies, 1720 to the Present, vol. 2. Ed. William J. Hausman. German Historical Institute. Last modified May 7, 2015. http://www.immigrantentrepreneurship.org/entry.php?rec=20.

Auletta, Ken. Greed and Glory on Wall Street: The Fall of the House of Lehman. 1st ed. New York: Random House, 1986.

Birmingham, Stephen. Our Crowd: The Great Jewish Families of New York. New York: Harper and Row, 1967.

Birmingham, Stephen. The Grandees: America’s Sephardic Elite. 1st ed. New York: Harper & Row, 1971.

Chapman, Peter. The Last of the Imperious Rich: Lehman Brothers, 1844–2008. New York: Portfolio, 2010.

“Department Store of Investment.” Time Magazine 87, no. 8, February 25, 1966.

Ehrich, Louis R. “In Memory of Mayer Lehman.” In Memoriam, Mayer Lehman. 1897.

Eichengreen, Barry. Hall of Mirrors: The Great Depression, the Great Recession, and the Uses—and Misuses—of History. New York: Oxford University Press, 2015.

Evans, E. N. The Provincials: A Personal History of Jews in the South. New York: Free Press Paperbacks, 1997.

Evans, E. N., and J. L. Loeb Jr. An American Experience: Adeline Moses Loeb (1876–1953) and Her Early American Jewish Ancestors. New York: Syracuse University Press, 2009.

Flade, Roland. The Lehmans: From Rimpar to the New World: A Family History. Würzburg: Königshausen & Neumann, 1999.

Kohler, Max J. Judah Touro, Merchant and Philanthropist. Baltimore, 1905.

Lehman, Robert. “Investment Management and the Lehman Corporation,” undated. Lehman Brothers Records, Harvard Business School, b. 674.

Lewis, Edmund Harris. “The Contribution of Judge Irving Lehman to the Development of the Law.” The Tenth Annual Benjamin N. Cardozo Lecture, delivered before the Association of the Bar of the City of New York, April 24, 1951.

Libo, Kenneth. “Lehman, From Cotton to Crash.” Jewish Daily Forward, September 26, 2008.

Libo, Kenneth. Lots of Lehmans: The Family of Mayer Lehman of Lehman Brothers. Remembered by His Descendants. New York: Syracuse University Press, 2007.

Loeb, John L., and Frances L. Loeb. All in a Lifetime: A Personal Memoir. 1st ed. New York: J. L. Loeb, 1996.

Loeb Jr., John L. John L. Loeb Jr.: Reflections, Memories and Confessions. New York: J. L. Loeb, 2017.

McDonald, Lawrence G. with Patrick Robinson. A Colossal Failure of Common Sense: The Inside Story of the Collapse of Lehman Brothers. New York: Crown Publishing Company, 2009.

McDonald, Oonagh. Lehman Brothers: A Crisis of Value. Manchester: Manchester University Press, 2016.

Montella, Erin Callan. Full Circle: A Memoir of Leaning in Too Far and the Journey Back. Sanibel, FL: Temple Press, 2016.

Nevins, Allan. Herbert H. Lehman and His Era. New York: Charles Scribner’s Sons, 1963.

Silverman, Joseph. “Spoken at the Funeral in Temple Emanu-El.” In Memoriam, Emanuel Lehman. 1907.

Tooze, Adam. Crashed: How a Decade of Financial Crises Changed the World. New York: Viking, 2018.

Williams, Mark T. Uncontrolled Risk: The Lessons of Lehman Brothers and How Systemic Risk Can Still Bring Down the Financial System. New York: McGraw-Hill, 2010.

Wise, T. A. “The Bustling House of Lehman.” Fortune, December 1957, 156–160.