Investment Banking & Securities Underwriting

By the late 1800s, the next generation of Lehmans began to enter the firm, including Meyer H. (son of Henry Lehman) and Arthur, Sigmund M., and Herbert H. (sons of Mayer Lehman). Emanuel’s son Philip joined the firm as a partner in 1885 and directed Lehman Brothers from 1901 to 1925. While Lehman Brothers increased its number of employees, until the 1920s only male members of the Lehman family could become partners. In 1924, John M. Hancock joined the partnership as the first non-family member. Like other Lehman partners, Hancock served on the boards of many of the firm’s clients.

![Sears, Roebuck Company. Sears; [catalog], 1908. Trade Catalog Collection, Baker Library, Harvard Business School.](https://cloudinary.hbs.edu/hbsit/image/fetch/q_auto,c_fill,ar_649:850,g_center/f_webp/https%3A%2F%2Fwww.hbs.edu%2Fctfassets%2Fpublic%2Fimages%2F1BhEBW8mh6U0LPmyMAOcn9%2FSears-Roebuck-Company.-Sears-catalog-1908.-Trade-Catalog-Collection-Baker-Library-Harvard-Business-School.jpg)

Sears, Roebuck Company. Sears; [catalog], 1908. Trade Catalog Collection, Baker Library, Harvard Business School.

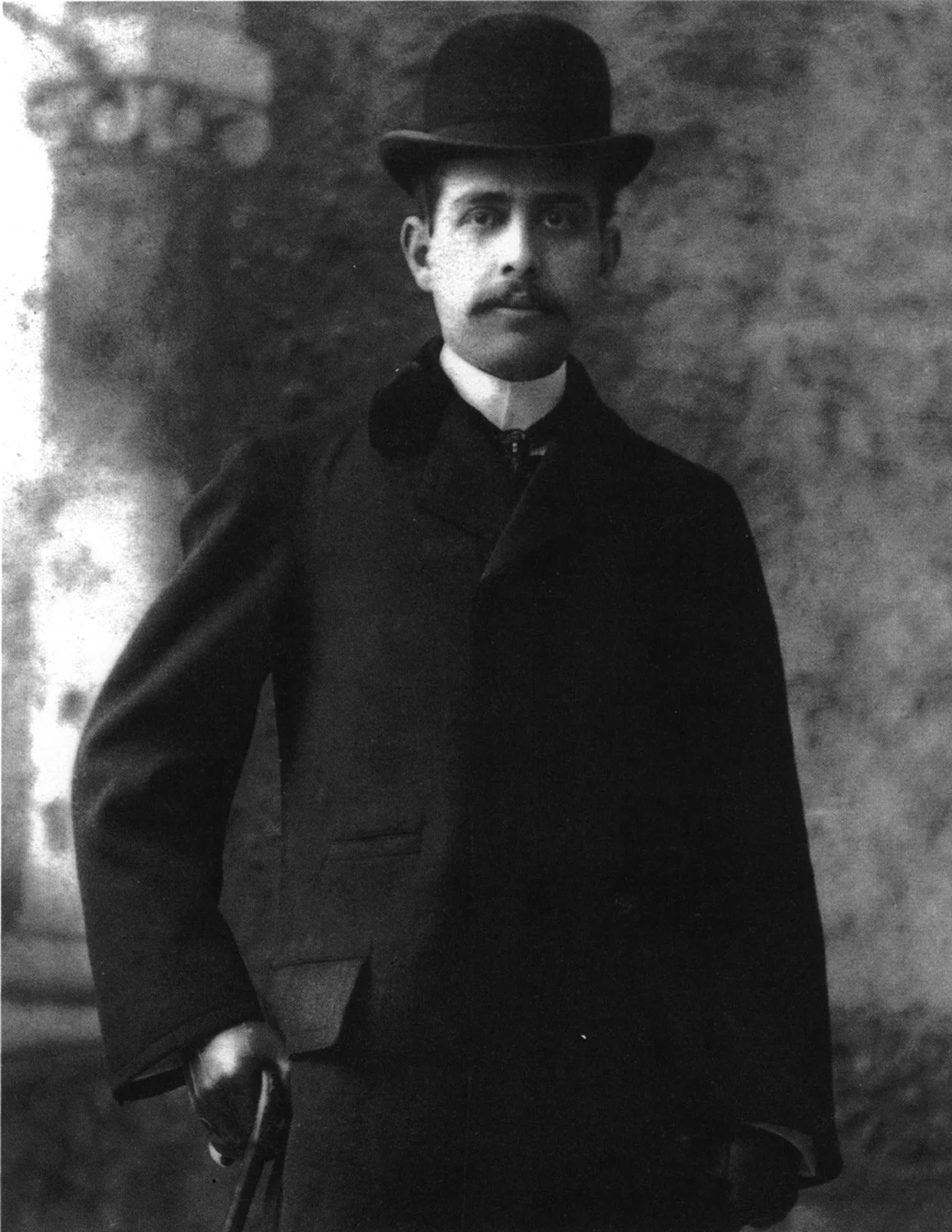

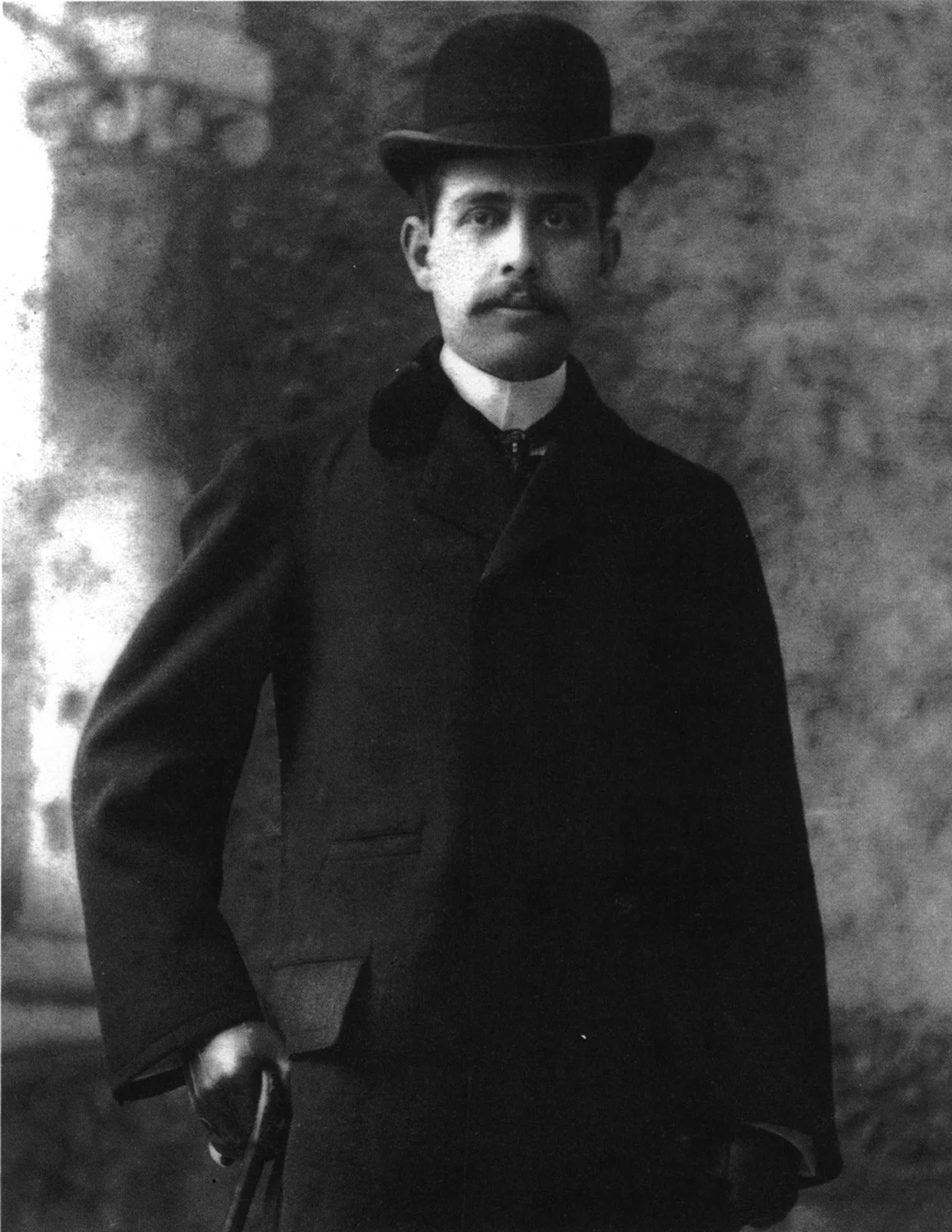

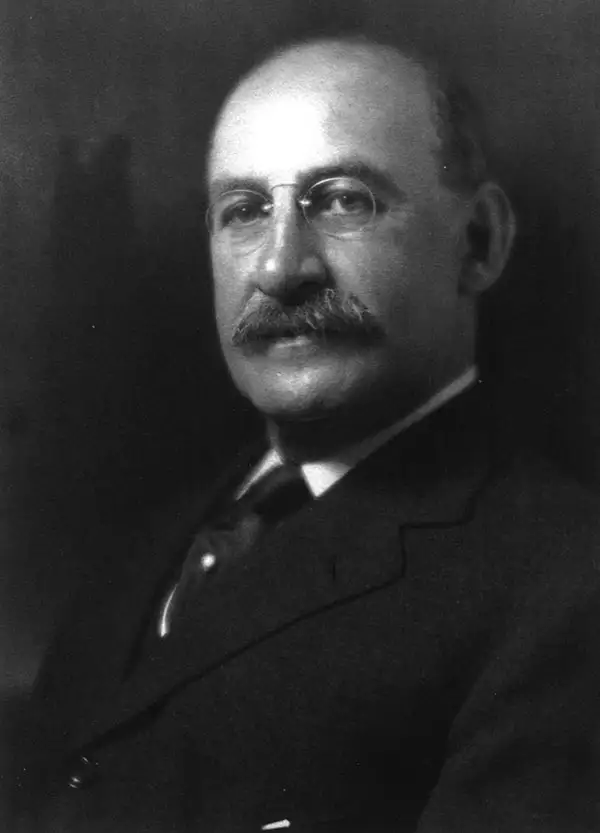

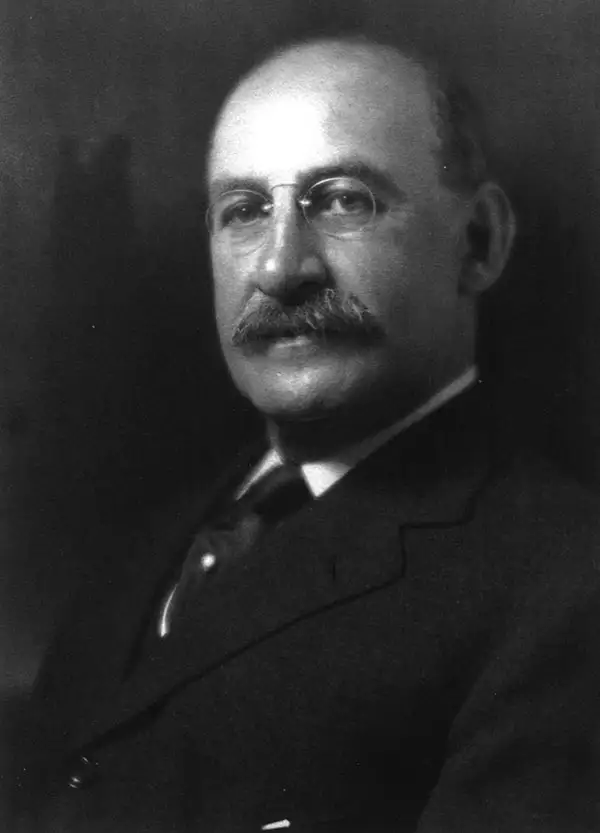

Arthur Lehman. Courtesy of Ambassador John L. Loeb Jr.

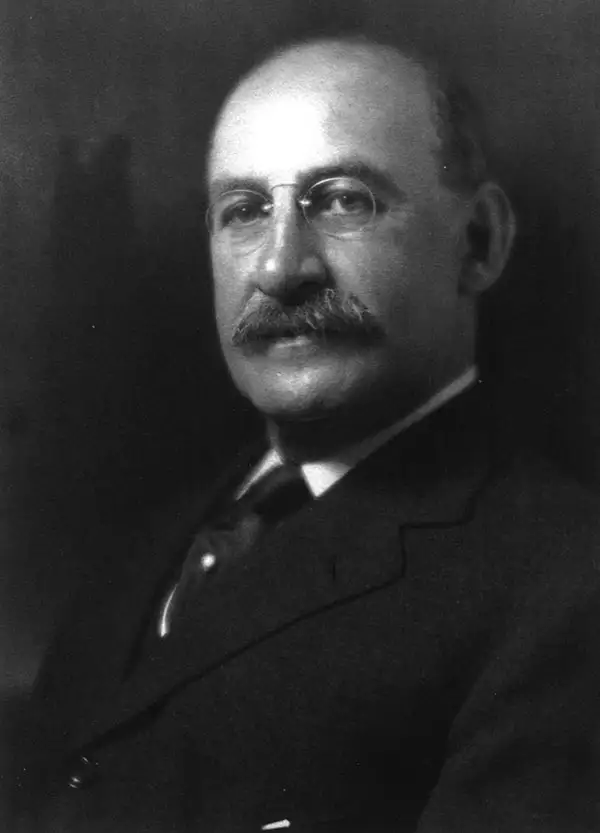

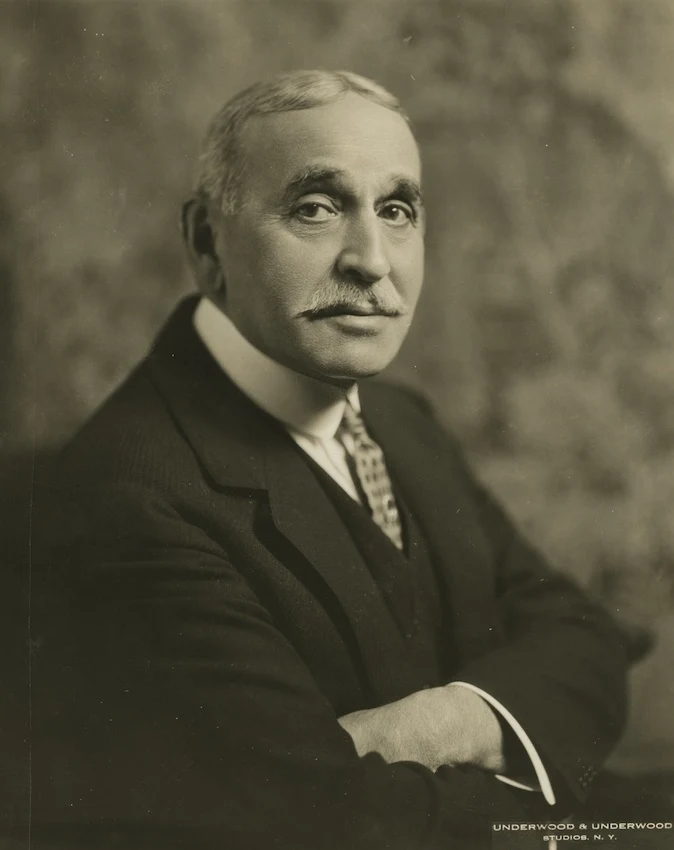

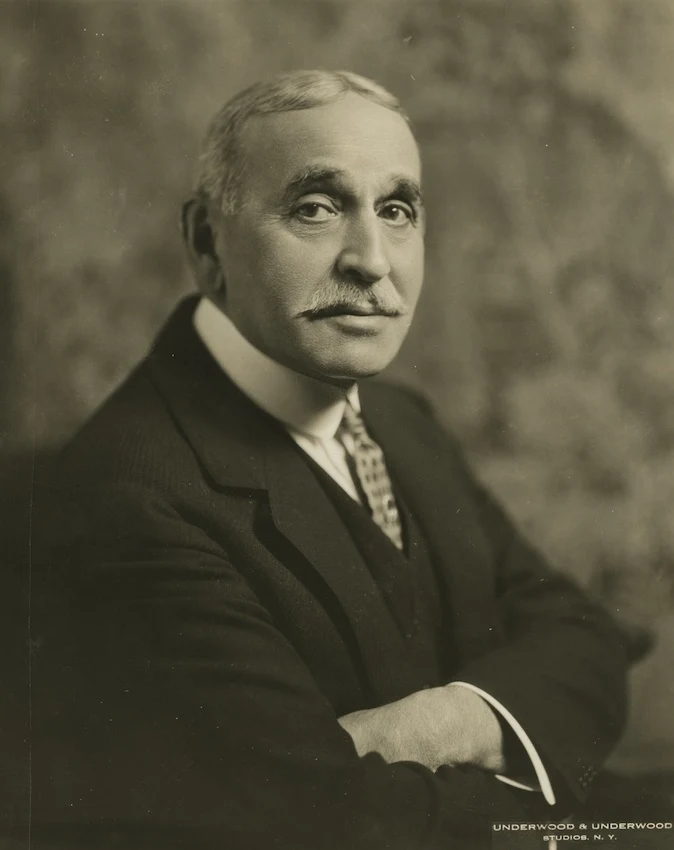

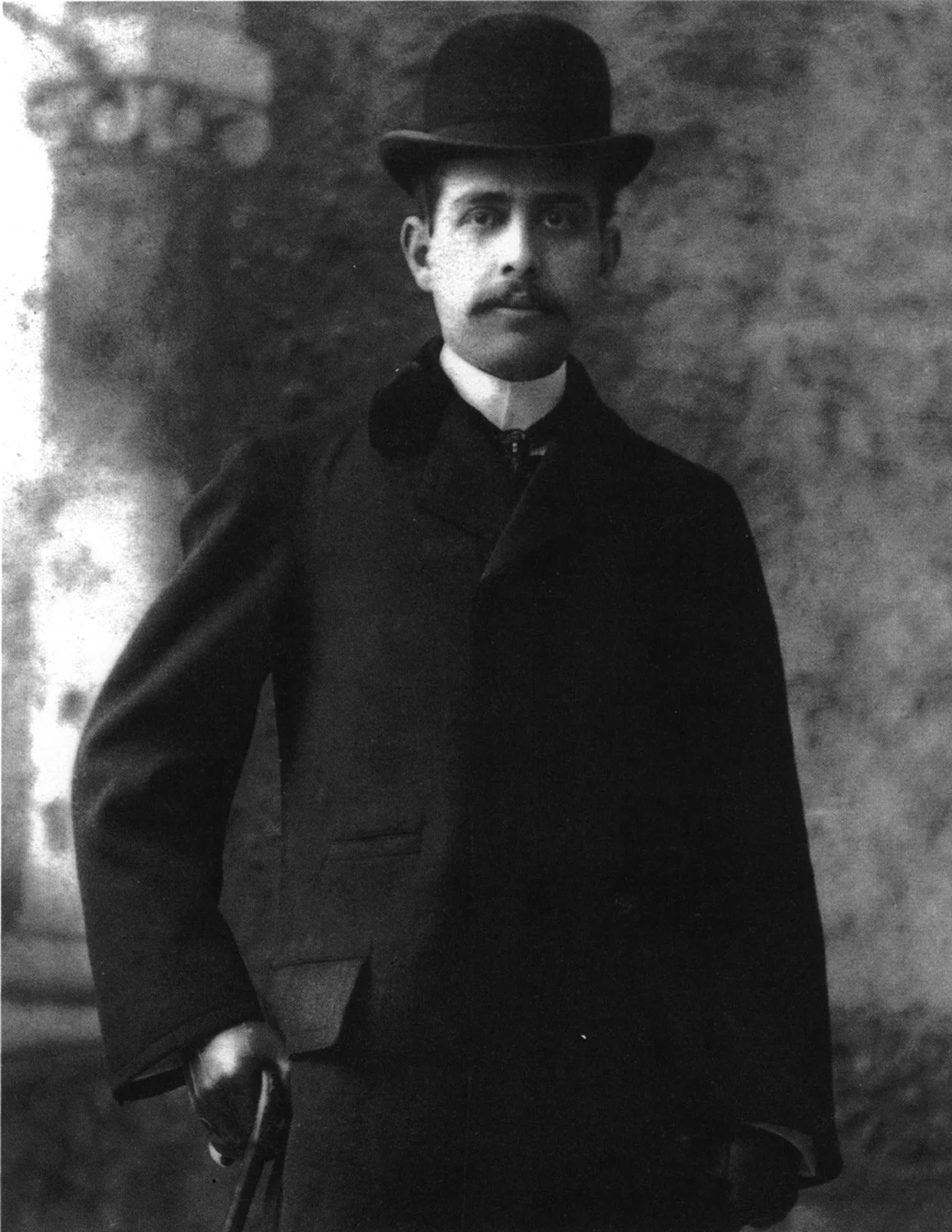

Sigmund M. Lehman. Courtesy of Ambassador John L. Loeb Jr.

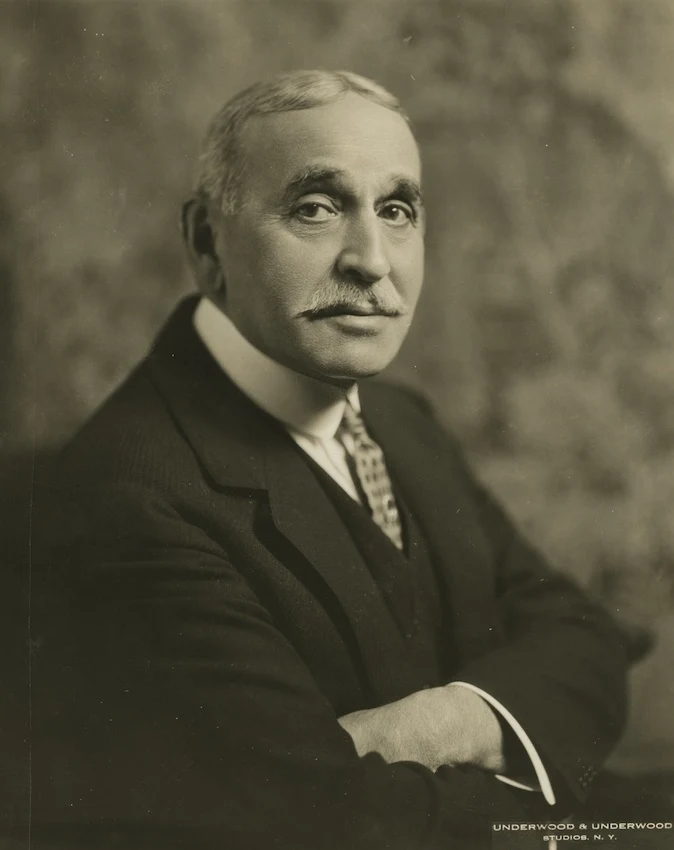

Philip Lehman. Lehman Brothers Records, Baker Library, Harvard Business School.

Arthur Lehman. Courtesy of Ambassador John L. Loeb Jr.

Sigmund M. Lehman. Courtesy of Ambassador John L. Loeb Jr.

Philip Lehman. Lehman Brothers Records, Baker Library, Harvard Business School.

![Sears, Roebuck Company. Sears; [catalog], 1908. Trade Catalog Collection, Baker Library, Harvard Business School.](https://cloudinary.hbs.edu/hbsit/image/fetch/q_auto,c_fill,ar_649:850,g_center/f_webp/https%3A%2F%2Fwww.hbs.edu%2Fctfassets%2Fpublic%2Fimages%2F1BhEBW8mh6U0LPmyMAOcn9%2FSears-Roebuck-Company.-Sears-catalog-1908.-Trade-Catalog-Collection-Baker-Library-Harvard-Business-School.jpg)

Sears, Roebuck Company. Sears; [catalog], 1908. Trade Catalog Collection, Baker Library, Harvard Business School.

Sigmund M. Lehman. Courtesy of Ambassador John L. Loeb Jr.

Philip Lehman. Lehman Brothers Records, Baker Library, Harvard Business School.

![Sears, Roebuck Company. Sears; [catalog], 1908. Trade Catalog Collection, Baker Library, Harvard Business School.](https://cloudinary.hbs.edu/hbsit/image/fetch/q_auto,c_fill,ar_649:850,g_center/f_webp/https%3A%2F%2Fwww.hbs.edu%2Fctfassets%2Fpublic%2Fimages%2F1BhEBW8mh6U0LPmyMAOcn9%2FSears-Roebuck-Company.-Sears-catalog-1908.-Trade-Catalog-Collection-Baker-Library-Harvard-Business-School.jpg)

Sears, Roebuck Company. Sears; [catalog], 1908. Trade Catalog Collection, Baker Library, Harvard Business School.

Arthur Lehman. Courtesy of Ambassador John L. Loeb Jr.

Under Philip Lehman’s leadership, Lehman Brothers made the transition into an investment banking house. The firm joined the New York Stock Exchange in 1887, situating the business in the heart of the country’s financial market. By the early twentieth century, securities in the form of stock became the preferred way of raising capital, and Lehman Brothers issued its first public stock offering for the International Steam Pump Company in 1899. “Underwriting was a potential means of transforming Lehman Brothers from an old commodities brokerage trading mainly in cotton—a product that in the United States was no longer as lucrative as it used to be—into a modern ‘house of issue,’” author Peter Chapman notes in his history of Lehman Brothers.1 By 1912, the Montgomery enterprise of Lehman, Durr & Co., which traded in cotton, proved no longer profitable, and that part of the firm was dissolved.

Philip Lehman partnered with his friend Henry Goldman, and together Lehman Brothers and Goldman Sachs issued a number of securities. General Cigar Company, Inc. and Sears, Roebuck & Co. were among their early underwriting ventures. J. P. Morgan and other established banks that had a hold on heavy industries like steel and railroads were reluctant to invest in riskier emerging fields such as retail—leaving an opening for smaller family firms like Lehman Brothers. “In an era when no self-respecting private banker would deign to back retail stores, textile manufacturers, clothing or cigarette makers—to say nothing of the indignity of mail-order houses and five-and-ten operations—Philip Lehman led his cousins directly into such businesses with quickly profitable results,” Stephen Birmingham writes in “Our Crowd”: The Great Jewish Families of New York.2

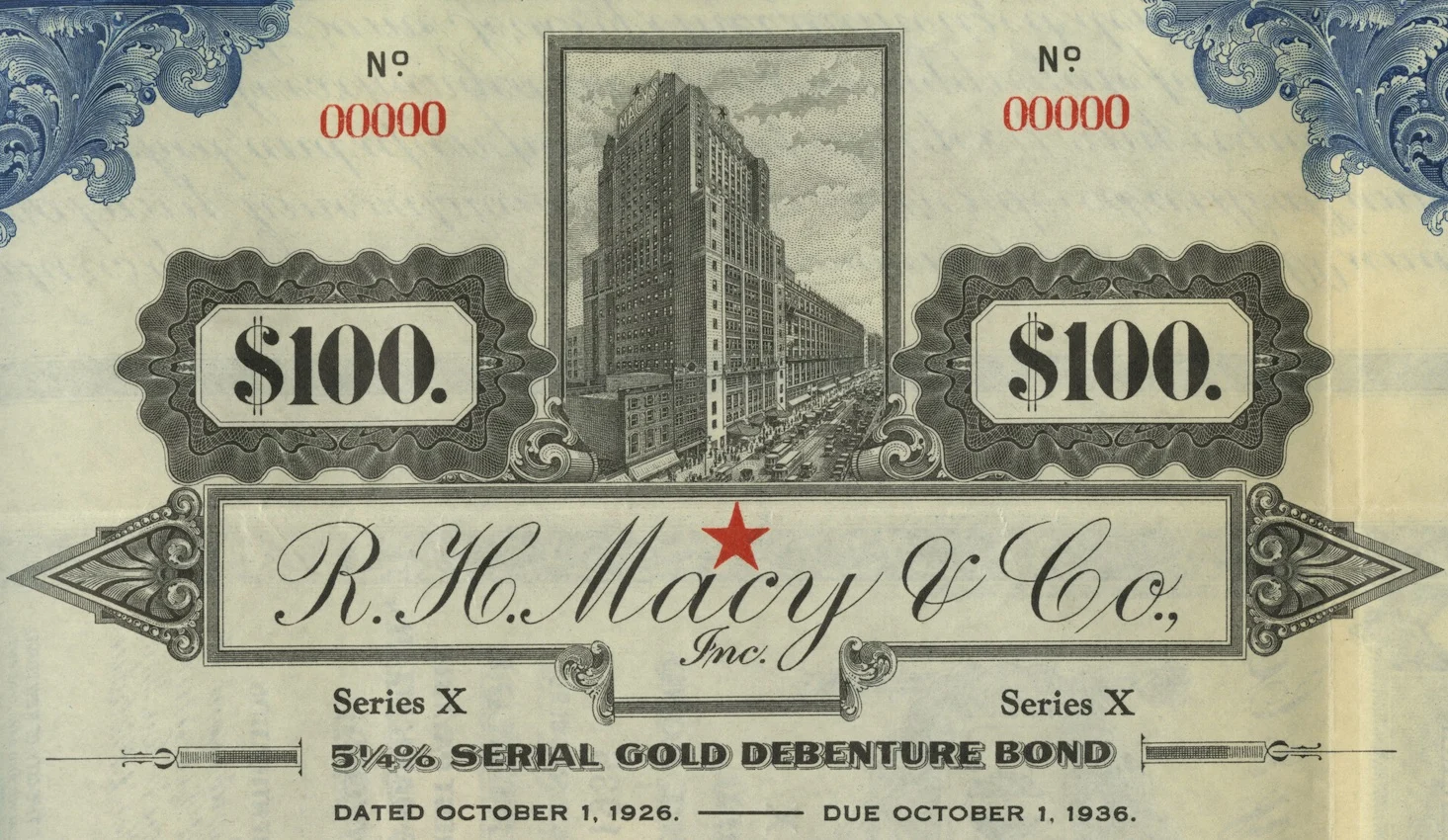

Lehman Brothers went on to underwrite securities for F. W. Woolworth Co., May Department Stores, Gimbel Brothers, Inc., and R. H. Macy & Co. As noted in Lehman Brothers: A Centennial: “Philip Lehman especially was sensitive to the amazing industrial and technological developments [that] unfolded during his lifetime. Until then the emphasis of economic progress had been on production, on opening and developing our continental treasure house. Imperceptibly but surely it was now switching to distribution, in line with a rapid rise of living standards for the population. . . . It was accordingly natural that financial and commercial devises for bringing more products to more people should be developed: department stores, chain stores, mail-order salesmanship, etc.”3

R. H. Macy & Co., Inc., Stock Certificate, October 1, 1926. Lehman Brothers Deal Books, Baker Library, Harvard Business School.

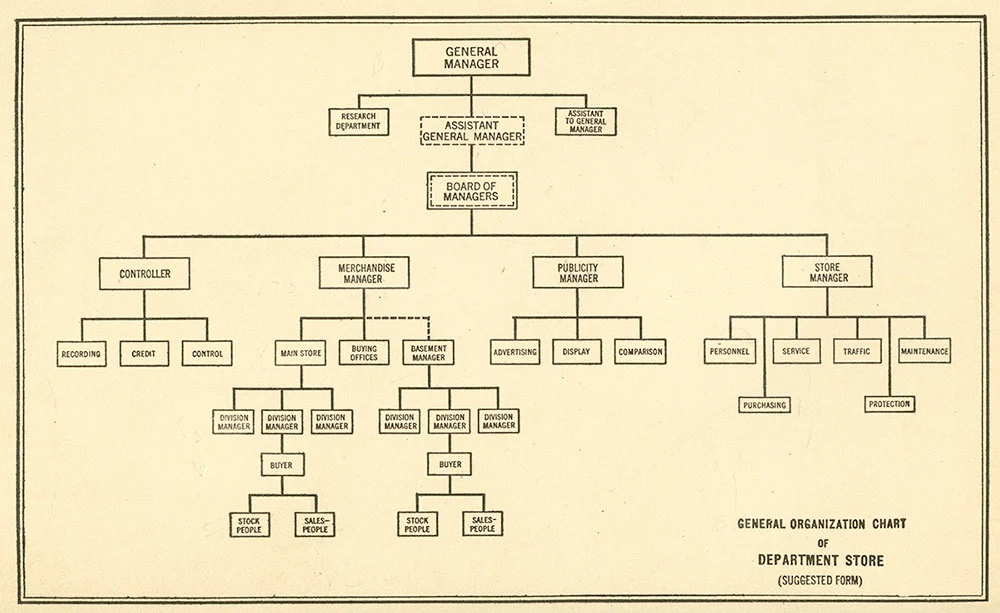

Paul M. Mazur, a Harvard-trained economist and partner in Lehman Brothers, helped spearhead the creation of department store groups such as Federated Department Stores, Allied Department Stores, and Interstate Department Stores. In 1927, Mazur published Principles of Organization Applied to Modern Retailing. Commissioned by the National Retail Dry Goods Association in collaboration with Harvard Business School, the book became a standard textbook in business schools.

Paul M. Mazur and Myron Samuel. Principles of Organization Applied to Modern Retailing. New York: Harper & Bros., 1927.

Lehman Brothers also issued bonds for public utilities and branched into the business of advising on mergers and acquisitions. Within a generation, the firm had made the successful transition from commodities brokers to an investment banking house in the country’s financial capital.

- Peter Chapman, The Last of the Imperious Rich: Lehman Brothers 1844–2008 (New York: Portfolio Penguin, 2010), 52.back to text ↑

- Stephen Birmingham, “Our Crowd”: The Great Jewish Families of New York (New York: Harper & Row, Publishers, 1967), 361.back to text ↑

- A Centennial: Lehman Brothers 1850–1950 (New York: Lehman Brothers, 1950), 27–28.back to text ↑