Global Impact of the Collapse

Great Recession

After Lehman Brothers declared bankruptcy in September 2008, approximately twenty-six thousand of the firm’s employees worldwide lost their jobs, and investors suffered immense losses, fueling the country’s greatest economic downturn since the crash of 1929. On September 16, 2008, one day after Lehman’s collapse, the Federal Reserve Bank of New York lent $85 billion to the global insurance company American International Group (AIG), whose assets failed to cover its mounting credit default swap contracts. As confidence in the banks eroded, borrowing rates rose and home foreclosures continued to spike. Lawrence McDonald, author and a former vice-president at Lehman Brothers, reflects back on the devastating cost brought about by the collapse, recognizing that “every fraction of every inch of those financial graphs represents hope or fear, confidence or dread, triumph or ruin, celebration or sorrow.” (1)

Investors in financial products related to Lehman Brothers protest in Hong Kong, October 31, 2008. Courtesy of AP Photo/Vincent Yu.

Workers embrace outside the offices of Lehman Brothers in Canary Wharf in London, Monday, September 15, 2008. Courtesy of AP Photo/Kirsty Wigglesworth.

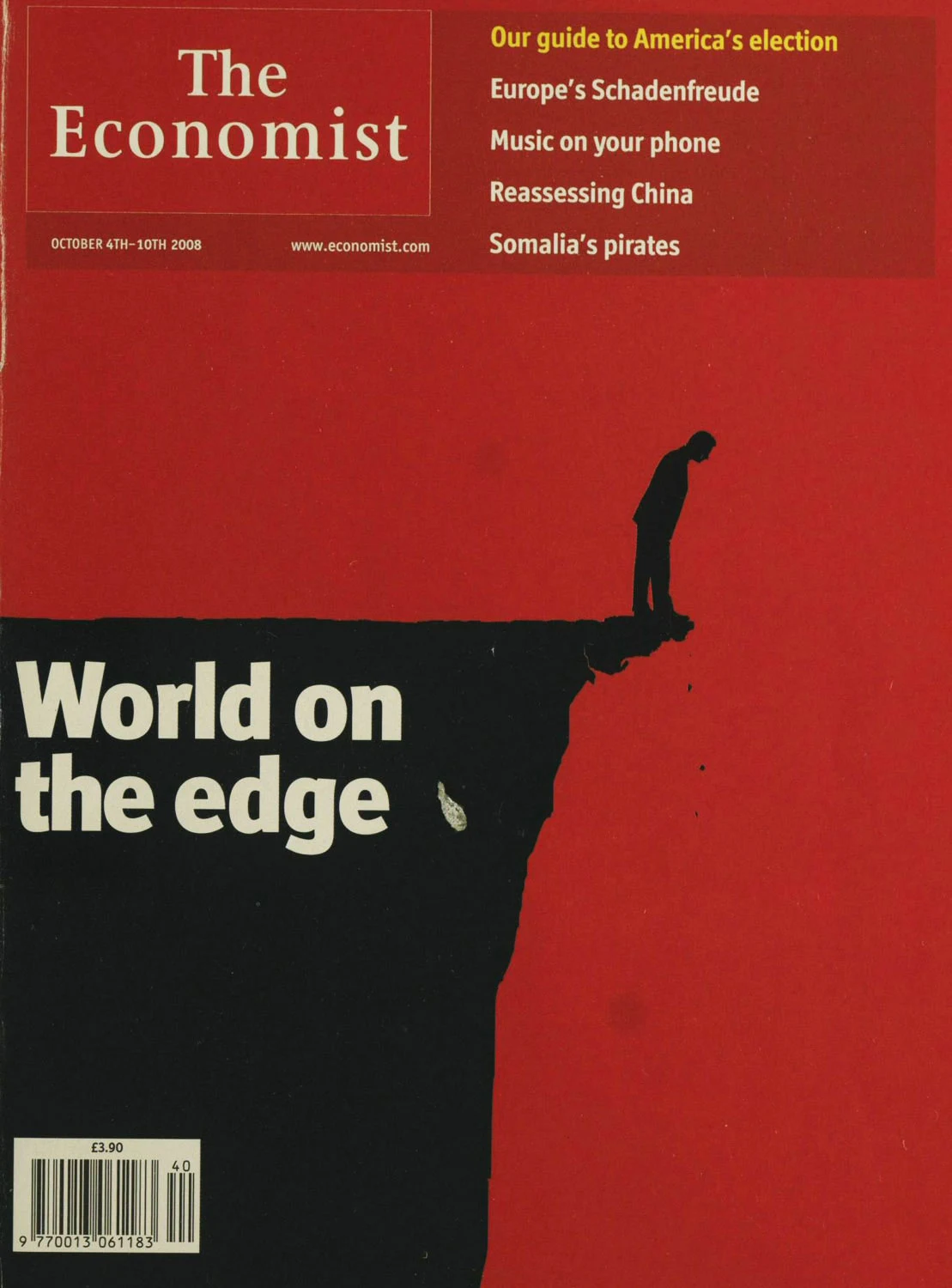

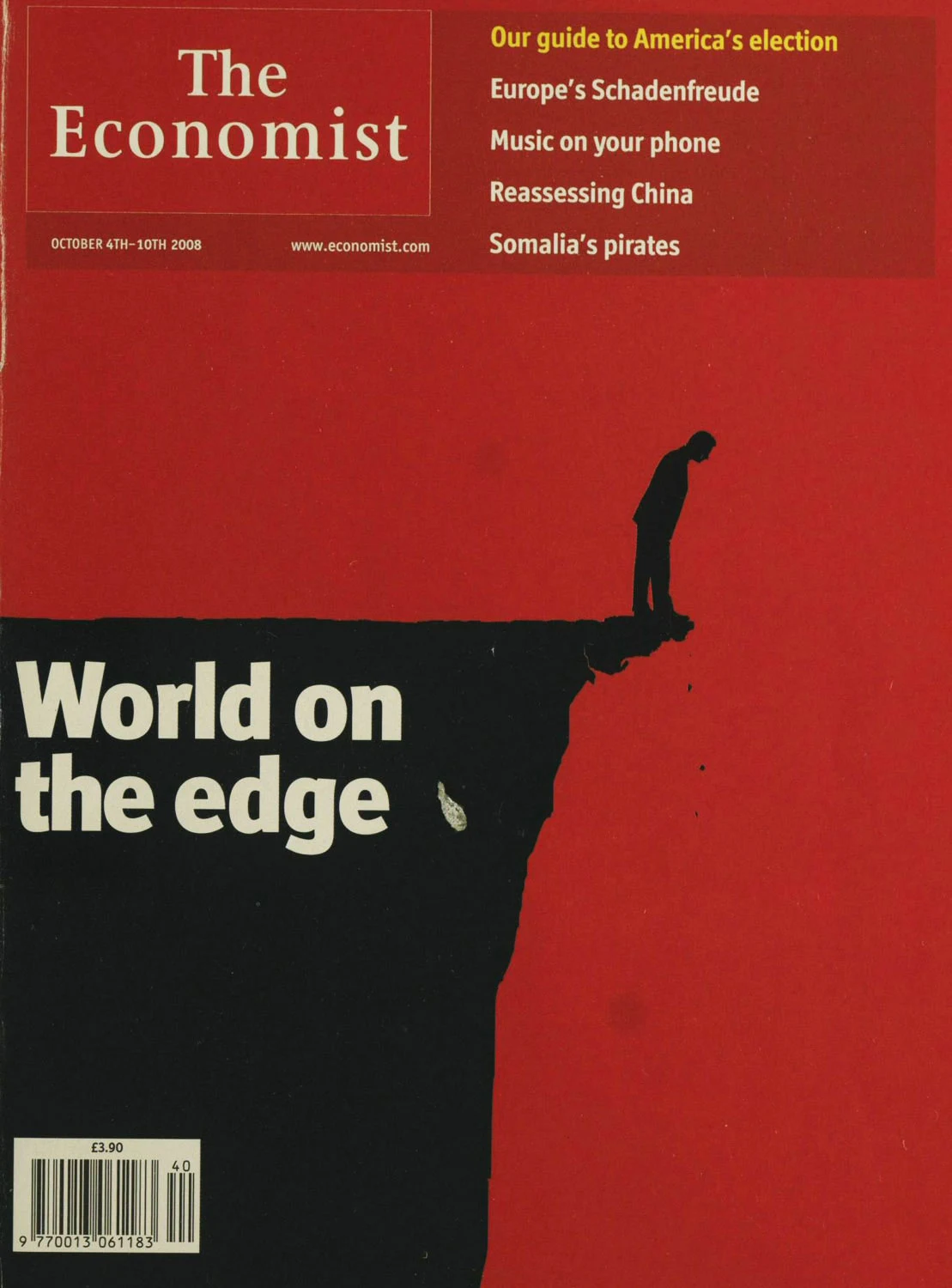

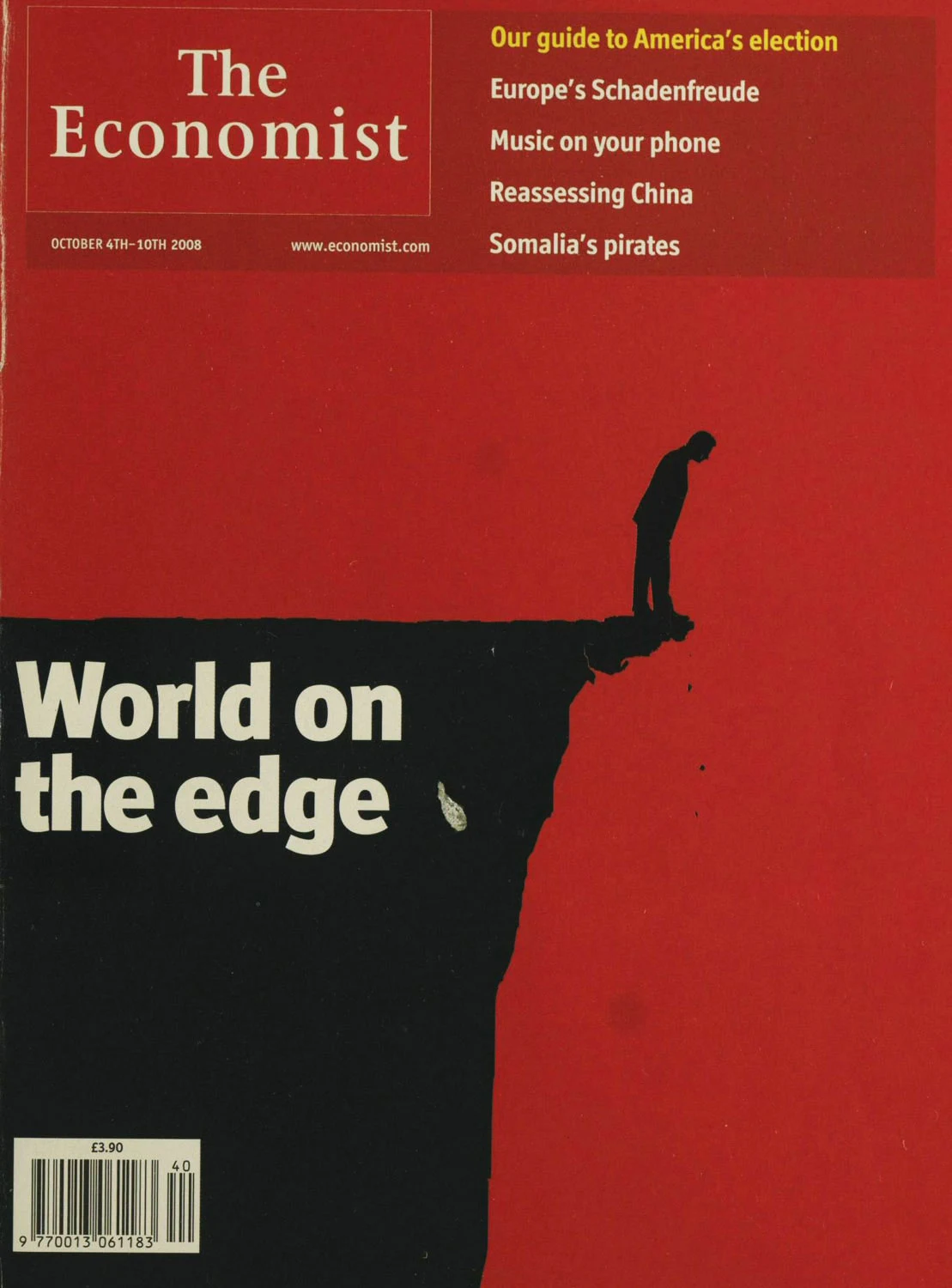

The Economist, October 2008. © The Economist Newspaper Limited, London (October 4, 2008).

The Economist, September 2018. © The Economist Newspaper Limited, London (September 8, 2018).

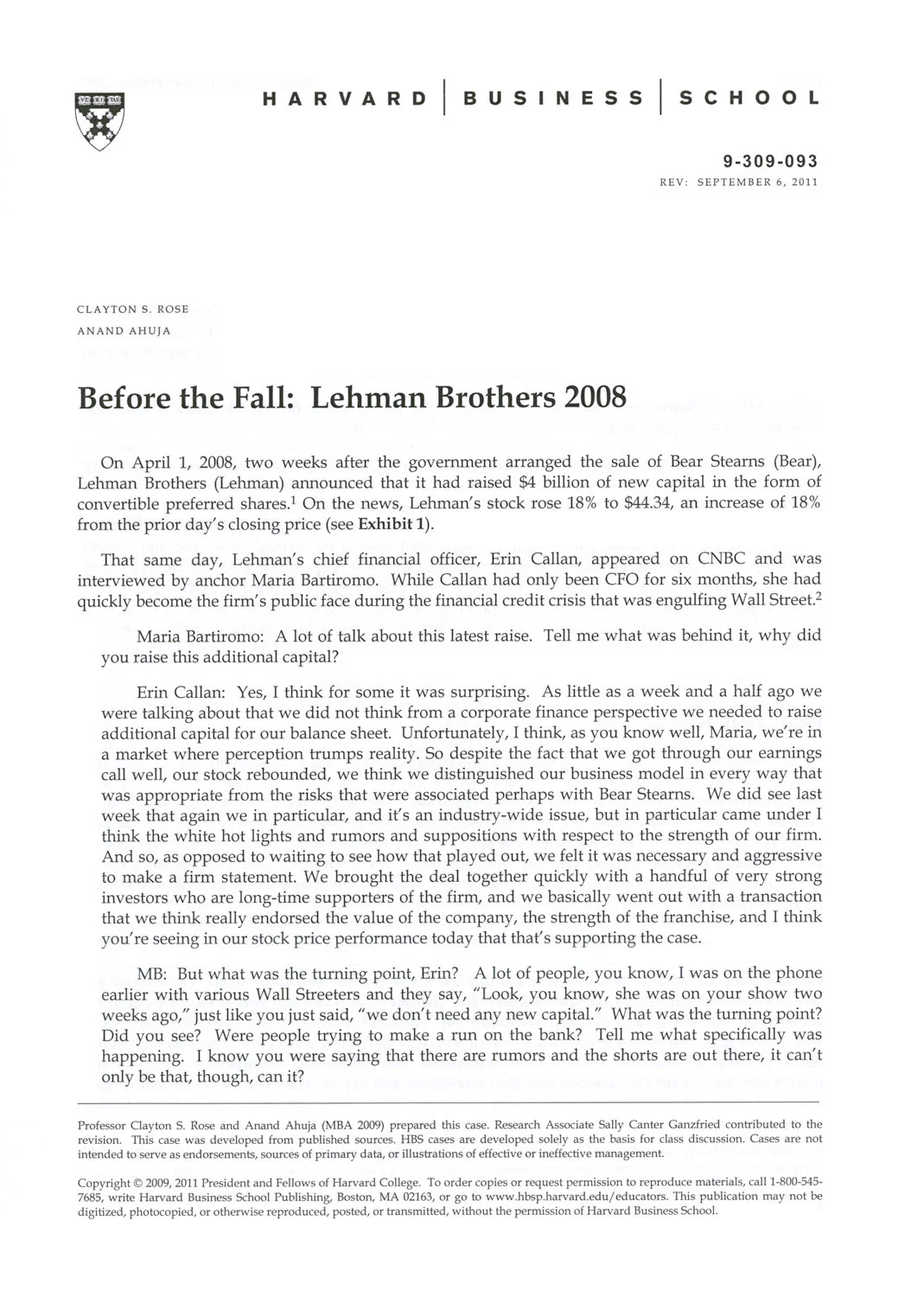

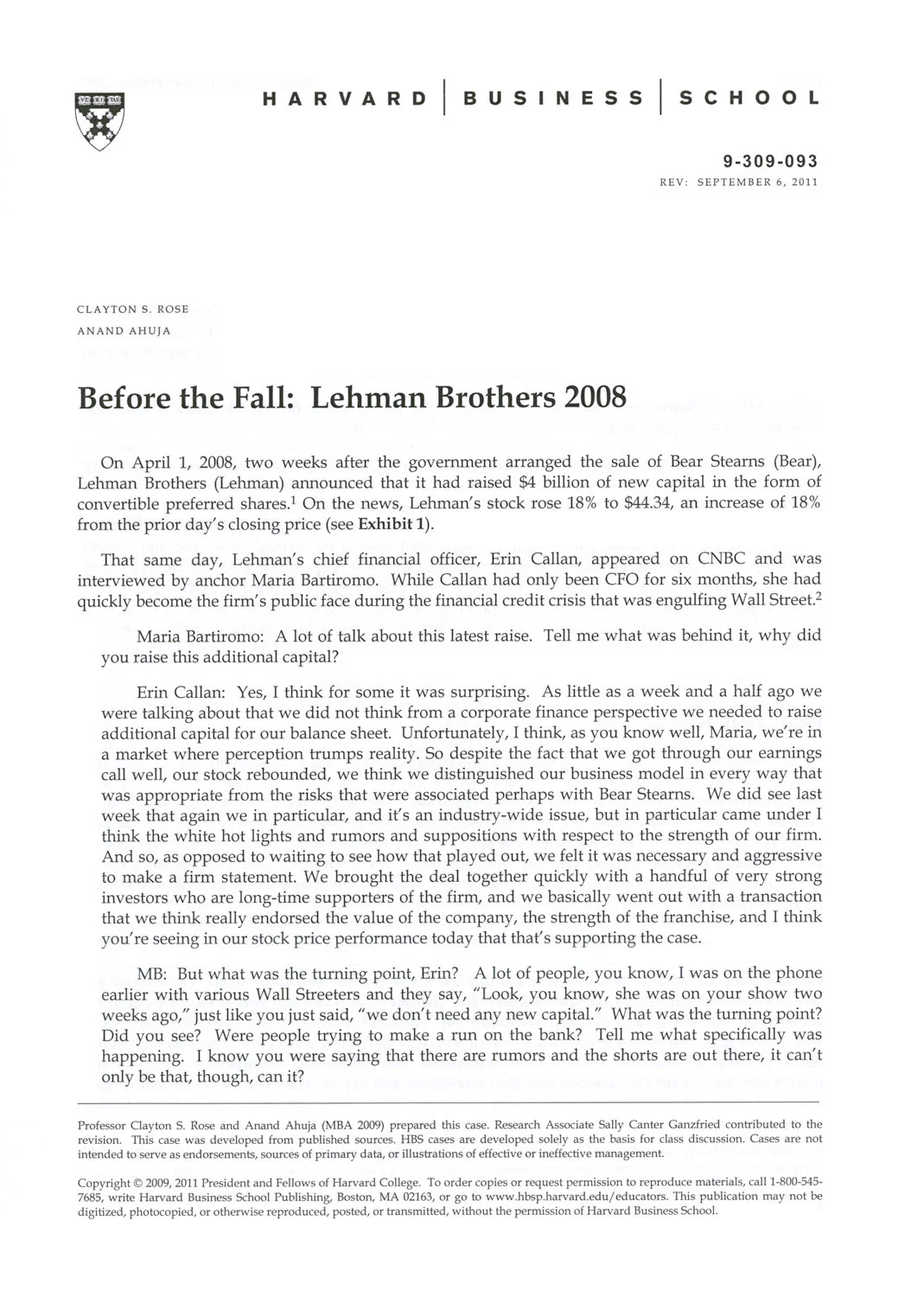

Rose, Clayton S., and Anand Ahuja. "Before the Fall: Lehman Brothers 2008." HBS No. 309-093. Boston: Harvard Business School Publishing, 2009 (revised 2011).

The Economist, October 2008. © The Economist Newspaper Limited, London (October 4, 2008).

The Economist, September 2018. © The Economist Newspaper Limited, London (September 8, 2018).

Rose, Clayton S., and Anand Ahuja. "Before the Fall: Lehman Brothers 2008." HBS No. 309-093. Boston: Harvard Business School Publishing, 2009 (revised 2011).

Workers embrace outside the offices of Lehman Brothers in Canary Wharf in London, Monday, September 15, 2008. Courtesy of AP Photo/Kirsty Wigglesworth.

The Economist, September 2018. © The Economist Newspaper Limited, London (September 8, 2018).

Rose, Clayton S., and Anand Ahuja. "Before the Fall: Lehman Brothers 2008." HBS No. 309-093. Boston: Harvard Business School Publishing, 2009 (revised 2011).

Workers embrace outside the offices of Lehman Brothers in Canary Wharf in London, Monday, September 15, 2008. Courtesy of AP Photo/Kirsty Wigglesworth.

The Economist, October 2008. © The Economist Newspaper Limited, London (October 4, 2008).

On October 3, 2008, under the Troubled Asset Relief Program (TARP), the government addressed the mortgage crisis by infusing funds into U.S. banks and purchasing toxic assets and equity. In 2009, General Motors and the Chrysler Corporation declared bankruptcy. In March of that year, the Dow Jones plummeted its lowest level of 6,594, a decline of more than 50 percent since 2007, and the unemployment rate hit 10 percent. Retirement accounts tied to financial markets fell sharply. In 2010, Congress passed the Dodd-Frank Wall Street Reform Act, legislation increasing government regulation of the financial industry. While financial markets were ultimately stabilized by government policy, the economy still collapsed.

Global Impact

The collapse of Lehman Brothers followed by the close of its London office and other international subsidiaries sent shock waves through the global financial markets with a widespread ripple effect. Defaulted loans on houses in the United States, for example, could be linked to mortgage-backed securities issued to investors in Europe or Asia. Additionally, Lehman Brothers had been a major issuer of short-term debt in the form of commercial paper, and its collapse caused a credit freeze of this vital source of lending throughout the world. Decrease in both consumer spending and exports to the United States severely affected the flow of goods, manufacturing, and job growth in Europe and Asia. Stock markets plunged, resulting in the worst economic downturn in global markets since the Great Depression of the 1930s. Major debt crises ensued in Ireland, Spain, Greece, Portugal, and Cyprus. Stimulus packages enacted by China and by the G-20, the forum for the world’s major economies, eventually began to stabilize the global markets.

Looking Back

Lehman Brothers transitioned from a general store in the 1850s to an investment banking house by the turn of the twentieth century. The firm advised on corporate mergers, the sale and acquisition of companies, and investment portfolios for individuals, foundations, endowments, and pension funds. Lehman Brothers underwrote securities to raise capital for a range of businesses, supporting established companies as well as smaller, emerging enterprises. Since its beginnings, the firm showed vision in its ability to foresee the potential of diverse industries, including transportation, retail, entertainment, advertising, manufacturing, utilities, communications, and high tech. By 1957, Fortune magazine observed that “no firm can match Lehman for sheer virtuosity.” (2)

For over a century and a half, Lehman Brothers’ ability to seek out new investment opportunities contributed to the country’s economic growth, job creation, and standard of living. By the twenty-first century, with rising government deregulation of the financial sector, firms like Lehman Brothers became increasingly leveraged in speculative, short-term investments—failing to strike a balance between risk and return. Further, staring in the 1970s, income and wealth inequality in the United States began a steady rise with falling income mobility and middle- and lower-income households sinking into greater debt. The history of Lehman Brothers, author Peter Chapman writes, “mirrored the ascent to wealth and world leadership of the United States. Its story, furthermore, would provide a precise reflection of the ebbs and flows, and the rises and falls, of the American Dream.” (3)

In 2008, the collapse of Lehman Brothers and crumbling financial system, built on short-term investing strategies and a failure of sound investment practices, reverberated with seismic intensity around the globe. The financial crisis “turbocharged today’s populist surge, raising questions about income inequality, job insecurity, and globalization,” The Economist argues. “Policymakers have made the economy safer, but they still have plenty of lessons to learn.” (4) Financial meltdowns have occurred repeatedly through history. A decade after Lehman Brothers failed, debates continue: What steps could Lehman Brothers have taken to prevent bankruptcy? What is the role of government and regulation in the financial industry? What ethical obligations do investment banks have to their clients and to the public at large? In considering the interdependence of world economies and fracturing geopolitics, in what ways can the past inform the future? And how can a future global financial collapse of this magnitude be prevented?

Lawrence G. McDonald with Patrick Robinson, A Colossal Failure of Common Sense: The Inside Story of the Collapse of Lehman Brothers (New York: Crown Publishing Company, 2009), 339.

T. A. Wise, “The Bustline House of Lehman,” Fortune, December 1957, 158.

Chapman, The Last of the Imperious Rich, 2.

The Economist, September 8–14, 2018, 11.