1929: The Great Crash

Unique historical materials in Harvard University collections throw light on the role of the regional exchanges in the stock market crash of 1929, and the regulation of the securities industry during the New Deal.

The stock market bubble of the Roaring Twenties is legendary; less so is the rise of the regional exchanges, particularly the Boston Stock Exchange. Though NYSE business also increased, its proportion of the overall securities market decreased while business at the formerly sleepy regional exchanges increased several times over.14

Part of the popularity of the regional exchanges was due to the lax listing requirements that made them particularly attractive to firms engaging in dubious issues such as highly leveraged investment trusts. Firms listed on one of the regional exchanges were subject only to relatively toothless state regulations known as “blue sky laws” that were designed to keep companies from selling investors valueless securities such as shares in the sky. These firms could often be listed on other exchanges with no further questions asked—a practice that was sharply curtailed after 1929.15

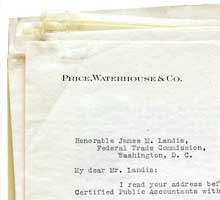

The securities legislation of 1933–1934 and subsequent founding of the Securities Exchange Commission (SEC) have been regarded as a successful chapter in financial regulation. These efforts bear the stamp of Harvard Professor of Law James Landis, one of the first legal academics to target the problem of regulation, until then left largely to elected legislators. Landis blamed the failure of previous regulation on a disconnect between legislation and administration, a dangerous gap he bridged both by careful drafting and by serving as chairman of the SEC. “Unlike so many draftsmen of regulatory legislation,” wrote Harvard Business School Professor Thomas McCraw, Landis “recognized the importance of matching the sanctions to the problems.” 16

One of the strengths of the New Deal’s SEC was its ability to co-opt various participants in the securities market, notably the accounting industry. Accountants initially viewed the new agency with suspicion. To gain their cooperation, Landis sagely positioned the SEC as an institution that would increase an accountant’s independence from corporate managers eager for favorable audits. Recent scandals notwithstanding, Landis’s methods dramatically improved accounting practices in the United States and the integrity of the securities market.17