Here's a tip for companies looking to woo customers away from the competition: Besides advertising fair prices for your products, try advertising fair wages for your employees.

Recent research from Harvard Business School indicates that shoppers prefer retailers that keep their CEOs' salaries in check. In sheer terms of gaining favor among consumers, a firm with a high CEO-to-worker pay ratio must offer a substantial 50 percent discount to keep up with a firm that maintains a low pay ratio. This is among the key findings in the working paper Paying Up for Fair Pay: Consumers Prefer Firms with Lower CEO-to-Worker Pay Ratios.

The perception of wage fairness affects purchasing intentions

"The perception of wage fairness affects purchasing intentions," says Bhavya Mohan, a doctoral student in the Marketing unit at HBS, who co-authored the paper with HBS marketing professors Michael I. Norton and Rohit Deshpandé.

Mohan's interest in the subject began when she was a kid, on a shopping trip with her father. "We were walking around Costco, and he turned to me and said, 'You know, what I love about this company is that the CEO makes fair pay compared to the workers,'" she says. "I remember thinking, oh, that must just be my dad; he must be the only person who cares about that."

The Dodd-frank Requirement

Fast-forward to 2010, when the US Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act. A response to the Great Recession, the act requires that regulators enact more than 200 rules related to disclosure and accountability. Among them: a requirement that all public companies disclose the annual salary of the chief executive, the median salary of all their employees, and the ratio of one to the other.

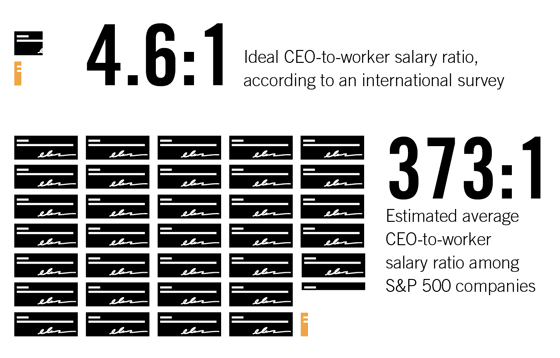

Sources: "How Much (More) Should CEOs Make? A Universal Desire for More Equal Pay" by Sorapop Kiatpongsan and Michael I. Norton, copyright 2014, Perspectives on Psychological Science "Executive Paywatch: High-paid CEOs and the Low-Wage Economy," copyright 2015, AFL-CIO

Thinking back to the Costco trip, Mohan wondered whether mandated pay ratio disclosure might affect consumer behavior. [Previous research](http://www.hbs.edu/faculty/Publication Files/kiatpongsan norton 2014_f02b004a-c2de-4358-9811-ea273d372af7.pdf) has shown that consumers consider 4.6:1 to be the ideal CEO-to-average-worker pay ratio. In reality, the average ratio among S&P 500 companies is roughly 373:1, according to 2014 information from the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO), which conducts an annual analysis of available labor data. Presumably, the Dodd-Frank rule, once it's mandated, will make more data available for such analyses.

The Security and Exchange Commission has scheduled a meeting on August 5 to consider finally enacting the rule, which it has been mulling for years. In October 2013, the SEC posted a request for comment on the idea of pay ratio disclosure. Subsequently, the agency received more than 126,000 letters, which were posted publicly online.

This provided Mohan with great data to start studying how consumers might react to the rule. A word-search analysis of the letters revealed that more than 25 percent mentioned the term "consumer," as in this line from one of the form letters on the SEC site: "Knowing which corporations heap riches upon their executives while squeezing struggling employees…will be a useful factor for me when considering which businesses to support with my consumer and investment dollars."

In short, Mohan's dad was clearly not the only consumer who cared about executive pay. But would knowledge of a company's pay ratio truly affect consumer behavior? To find out, Mohan teamed up with Norton and Deshpandé to conduct a series of experimental studies.

A Series Of Studies

In the first study, a group of online participants received a description of a product—a set of bath towels for sale at a hypothetical retailer.

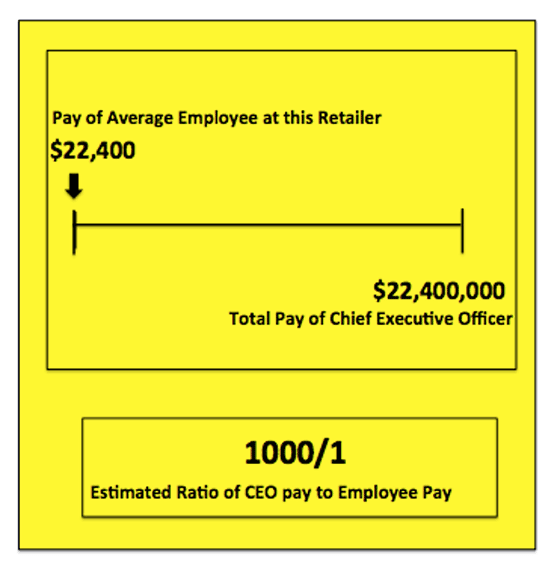

The participants were divided into two conditions. Half were told that 1000:1 was the ratio of the retailer's CEO's salary to the average employee's salary. The other half were told that the ratio was much lower: an idealistic 5:1. A related experiment raised the low ratio to a more realistic 60:1 but kept the high ratio at 1,000:1.

In each case, participants were asked how much they'd be willing to pay for the hypothetical towels. On average, participants were willing to pay more for the towels from the low-ratio firm than from the high-ratio firm.

In a follow-up experiment, participants compared two hypothetical retailers side by side. The question: Would participants choose to pay a little more for towels from a low-pay-ratio company than those from a high-pay-ratio competitor? The answer: 32 percent stated that they'd be willing to pay that premium.

The results held true when participants evaluated several other products, ranging from a box of cereal to a flat-screen TV. For every product, the researchers write, "the trend was such that willingness to buy was higher for the low-pay-ratio retailer."

A Potential Downside?

Still, the researchers wondered if there was a potential downside to disclosing low pay ratios. Might consumers reason that if a firm could afford to pay its CEO an eight-figure salary, it could also afford to manufacture higher-quality products than a firm that paid its CEO a six-figure salary?

With that in mind, they conducted a study that controlled for variations in product quality. Rather than shopping for specific hypothetical products like towels, participants shopped for gift cards. Again, overall, participants preferred the retailer with the low pay ratio.

A follow-up study explored a related possibility: Consumers might assume that a company with a low pay ratio was focused on wage equality to the detriment of product quality. Indeed, previous research has shown that consumers viewed nonprofits as warm but incompetent, whereas for-profits were viewed as cold but competent.

The results showed that participants' perceptions of a company's warmth didn't deter them from shopping there. Rather, the researchers saw lift on both. "People see the [low ratio] firm as warmer and more competent, suggesting that the potential downside risk of this type of disclosure is not seen in the same way as with nonprofits," Mohan says.

The researchers also tested whether a low CEO-to-worker pay ratio might alienate certain consumer groups, dividing 253 participants according to political affiliation. They found Democrats, Independents, and "others" were more willing to buy towels from retailers with low vs. high pay ratios. Republicans were indifferent; in their subgroup there was no significant difference in willingness to buy between the high-pay-ratio and low-pay-ratio retailers.

The Price Of Counterbalance

But would shoppers still favor low-pay-ratio retailers if they charged significantly higher prices than high-pay-ratio retailers? For the final study in the series, the researchers explored whether bargain prices would counterbalance the negative effects of a high pay ratio—and the mandated disclosure thereof.

Source: "Paying Up for Fair Pay: Consumers Prefer Firms with Lower CEO-to-Worker Pay Ratios."

The team hired a large group of online participants to report their willingness to buy towels under a variety of bargain pricing scenarios. The findings were significant: A high-pay-ratio retailer required a 50 percent discount to elicit a willingness to purchase the product that was on par with a low-pay-ratio retailer—even when the low-pay-ratio retailer was charging full price.

More recently, Mohan, Norton, and Deshpandé have been exploring the idea of actively marketing low- pay-ratio information to consumers. In one experiment, consumers shopped for flat-screen televisions. Along with the common "Energy Star" label indicating that certain energy efficiency standards had been met, among other labels, each TV included a label with the manufacturer's pay ratio.

In one experiment, consumers view products labeled with the salary ratio at the firm that manufactured the product. (Source: Bhavya Mohan)

Initial findings indicate that consumers respond to the label, even if nobody points it out to them. "They're seeing that label embedded with all this other information, and people still notice it," Mohan says. "They respond to energy, and they also respond to pay ratio."

Meanwhile, it's not clear when federal regulators will finally enact the pay-ratio-disclosure mandate. But some firms might do well to go ahead and disclose, with or without the mandate. As the researchers conclude in their paper, "Even if pay ratio disclosure does not become legally mandated, our results suggest that firms with low pay ratios relative to competitors may wish to begin to disclose this information voluntarily, as a means of garnering favorable consumer perceptions."