New Levels of Capitalism: Finance

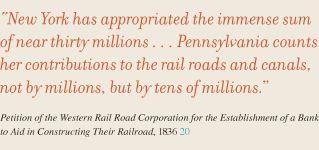

The rapidly growing industry required an extraordinary amount of capital for construction and operations. As railways expanded nationwide from the mid- to late 1800s, federal lands were surveyed and one tenth were set aside as land grants for railroad development. After the Civil War, state government subsidies began to be replaced by more substantial federal aid. Other major infusions of capital came from European sources, including German and British investors. The westward expansion of the railroad blazed the trail for transcontinental commerce in the second half of the 19th century. Entrepreneurs and capitalists like F. L. Ames, Jay Gould, J. P. Morgan, Cornelius Vanderbilt, and Henry Villard increasingly invested in the industry.

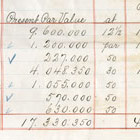

Until World War I the railroads represented a highest percentage of listed stocks and bonds issued on the New York Stock Exchange. The stock market grew from a few shares in the 1830s to hundreds of thousands in 1850 to millions by the mid-1860s. Investors could follow railroad companies in periodicals and newspapers including The American Railroad Journal (established in 1832); the New York Times (1851); The Stockholder: Monitor of Finance and Industry (1862); The Commercial and Financial Chronicle (1865); and the Wall Street Journal (1889). Investment banking houses assisted railroads in selling stock and underwriting securities for the railroads, which like other rising industries, would come to depend on a system of credit and financial markets.21

As the railroads increased so did corruption, which took many forms: absconding with public funds, distributing unfunded stock certificates, inflating public stocks, padding construction costs, and accepting bribes for political favors.22 When financial markets collapsed, the railroads exercised their considerable political influence and the state forgave loans or renegotiated payments. Richard White maintains that “the railroads and the modern state were coproductions. . . . Congress and the courts created ways in which corporations could fail repeatedly and arise again.”23