- Introduction

- EDUCATION

- INNOVATION & VC

- GLOBAL LEGACY

In the 1930s, investments were generally targeted for trusts, pensions, and other conservative funds rather than emerging industries.32 The urgent military needs during World War II had fostered the rapid creation of new products and technologies. "By partaking in the development of new technologies and industries during the war, the US government had assumed significant risk," HBS Professor Tom Nicholas asserts. "The fact that several of these risks paid off–in ways that Doriot had seen firsthand–primed investors to take similar risks following the war."33

In 1946, Doriot became president of American Research and Development Corporation (ARD), the first publicly funded venture capital firm and one of the first modern venture capital companies established after the war. Located in Boston, ARD offered entrepreneurs financial resources and managerial support.34 In the first half of the century, wealthy family funds like the Rockefeller Brothers, Inc. (later Venrock) provided the majority of investments for private companies. ARD would be one of the first firms to grant private equity from non-family funds, ushering in what became known as modern venture capital industry.

"We are a movement, not just a company. A commercial bank lends only on the strength of past successes and proven assets. I want money to do things that have never been done before."

Georges F. Doriot, in Shawmut News Bulletin, 196131

ARD founders included Karl Compton, president of the Massachusetts Institute of Technology (MIT); Ralph Flanders, president of the Federal Research Bank in Boston and later senator from Vermont; Merrill Griswold, head of Massachusetts Investments Trust; and Donald K. David, dean of the Harvard Business School. Edwin R. Gilliland, head of the chemical engineering department at MIT, and Jerome C. Hunsaker, head of the aeronautical engineering department at MIT, served as technical consultants. With Doriot's support, Dorothy Rowe, who started as Doriot's administrative assistant at ARD, eventually rose to senior vice presidency at the firm, served as a director of a number of its portfolio companies, and became one of the leading women in the US venture capital field.

A steady stream of individuals who trained at HBS entered the Quartermaster Corps, and Doriot also reached out to HBS graduates to assist him in the war effort. William H. McLean (HBS MBA '34), Doriot's former teaching assistant, served as Doriot's chief assistant throughout the war. Henry W. Hoagland (HBS MBA '39), another student of Doriot's, also worked as an aide to Doriot in the Military Planning Division.

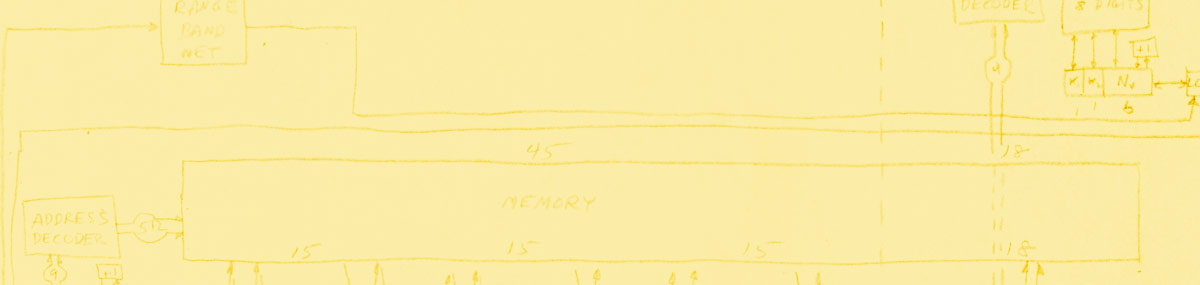

At ARD, Doriot received hundreds of proposals but invested in only a small percentage of them. The firm's prized portfolio companies included Circo Products (automobile tools); High Voltage Engineering Corp (high-powered generators and nuclear particle accelerators); Tracerlab, Inc. (analytical instruments and radiation detectors); Baird Associates (chemical analysis instruments); and Ionics (water purification). Doriot did not believe in turning companies around for an instant profit but rather staying with them for the long term and through challenging periods. William E. Barbour, Jr., the founder and president of Tracerlab, recalled, "The general provides the two things that a young scientific organization most needs–enthusiasm and appreciation. Like all the others, I started out with a hatful of ideas and a lot of long-range plans. In a couple of years, I got bogged down in detail. Doriot stepped in just in time to pull me out of the rut."45

While ARD started out with an uneven performance, suffering some initial losses, it showed consistent gains by 1955. "We cannot depend safely for an indefinite time on the expansion of our old big industries alone," ARD co-founder Flanders asserted. "We need new strength, energy and ability from below. We need to marry some small part of our enormous fiduciary resources to the new ideas which are seeking support."36

Doriot continued to teach at HBS, conveying lessons learned from the early days of the venture capital industry to his students, many of whom–including William Elfers (HBS MBA '43), Henry Hoagland (HBS MBA '39), and Charles Waite (HBS MBA '59)–would come to work for ARD. "[Doriot] probably had more to do with the formation of this business than any other single person," Waite notes. "[I]t was still an academic experiment in some ways, because Doriot was head of it, and he was more than anything else a teacher."37 Doriot championed the interplay of new ideas and creative individuals, the same principles he espoused at HBS. "Creation of processes and products, of ideas and industries, depends on men more than money, on imagination as well as initiative," Doriot wrote. "Seek out creative men with the vision of things to be done. Help breathe life into new ideas and processes... with more than capital–with sensitive appreciation for creative drive... with loyalty to the idea and to its initiator, the creative man."38

31

Doriot quoted in "Profile of Shawmut Director Georges F. Doriot, President, American Research & Development Corporation," Shawmut News Bulletin, 20 January 1961, 2.

32

Tom Nicholas and David Chen, "Georges Doriot and American Venture Capital," Harvard Business School 9-812-110 (12 January 2012): 5.

33

Nicholas and Chen, 6.

34

Doriot first served as chairman of the board of advisors of ARD and in December 1946 assumed the role of President of the company, by which time he had left active duty in the army.

35

William E. Barbour, Jr. quoted in "They're Products of the Future," Business Week, 28 February 1953: 101.

36

Ralph Flanders, "Address to the National Association of Security Commissioners," Chicago, November, 1945 quoted in Patrick R. Liles, Sustaining the Venture Capital Firm (Cambridge, MA: Management Analysis Center, 1977), 28.

37

"Done Deals - Waite," excerpt from Udayan Gupta, ed., Done Deals: Venture Capitalists Tell Their Stories (Boston: Harvard Business School Press, 2000), featured in Working Knowledge, Harvard Business School, 26 March 2001, http://hbswk.hbs.edu/archive/2140.html.

38

Doriot, ARD Annual Report, 1971. GFD-HBS.